MPF Products

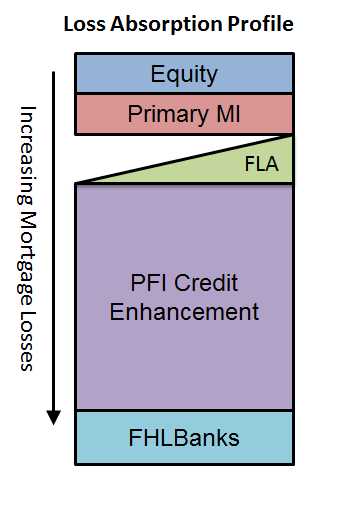

Funding mortgage loans under the MPF Original product allows your Federal Home Loan Bank (FHLBank) to manage the liquidity, interest rate, and prepayment risks of the loans while you manage the credit risk of the loans. MPF Original provides you additional income for sharing in the credit risk with your FHLBank. Should a loan loss occur, the credit risk sharing feature of MPF Original allocates those losses after borrower equity and private mortgage insurance are depleted through a loss structure designed to share the remaining loan loss between the FHLBank and you.

Features

- Additional income for sharing in the credit risk

- Remittance options: Actual/Actual, Actual/Actual Single Remittance, Scheduled/Scheduled

- Servicing Fees: 25 basis points (0.25%) annualized, paid monthly

- Delegated Underwriting; DU and LPA maybe used to assist in making the underwriting decision

Benefits

- No loan-level price adjustments

- Competitive execution

- Additional income for quality loans

- Same-day delivery and funding

- Servicing-released options available

Actual/Actual Remittance features a remittance option similar to agency actual/actual, with monthly reporting and competitive up-front price. This option is structured so that Servicers transfer funds to their FHLBank non-interest bearing custodial deposit account whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Frequency – Whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

- Non-interest bearing custodial P&I account maintained at the FHLBank

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount

- Scheduled P&I, less a servicing fee (remitted the current month)

- Unscheduled principal (curtailments and payoffs remitted the month following receipt);

- 30-days interest expense on payoffs and curtailments

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the 18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

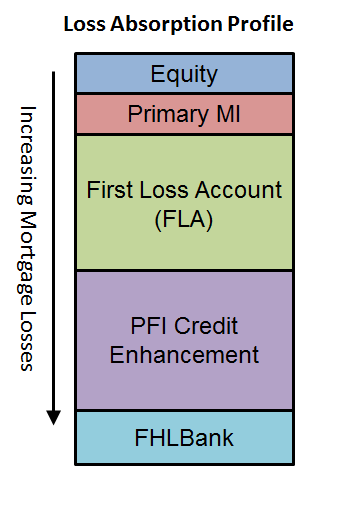

Funding mortgage loans under the MPF 125 product allows your Federal Home Loan Bank (FHLBank) to manage the liquidity, interest rate, and prepayment risks of the loans while you manage the credit risk. MPF 125 establishes the FHLBank First Loss Account at the time of funding and provides you with additional income for sharing in the credit risk with your FHLBank. When a loss occurs, the credit risk sharing feature of MPF 125 allocates those losses after borrower equity and private mortgage insurance are depleted through a loss structure designed to share the remaining loan loss between the FHLBank and you.

Features

- The additional income is performance-based, paid monthly net of any losses allocated to the First Loss Account

- Remittance options: Actual/Actual, Actual/Actual Single Remittance, Scheduled/Scheduled

- First Loss Account: 100 basis points of the principal amount of the Mortgage Loans funded under a Master Commitment at the time of funding

- Servicing Fees: 25 basis points (0.25%) annualized, paid monthly

- Delegated Underwriting; DU and LPA maybe used to assist in making the underwriting decision

Benefits

- No loan-level price adjustments

- Competitive execution

- Additional income for quality loans

- Same-day delivery and funding

- Servicing-released options available

Actual/Actual Remittance features a remittance option similar to agency actual/actual, with monthly reporting and competitive up-front price. This option is structured so that Servicers transfer funds to their FHLBank non-interest bearing custodial deposit account whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Frequency – Whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

- Non-interest bearing custodial P&I account maintained at the FHLBank

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount

- Scheduled P&I, less a servicing fee (remitted the current month)

- Unscheduled principal (curtailments and payoffs remitted the month following receipt);

- 30-days interest expense on payoffs and curtailments

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the 18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

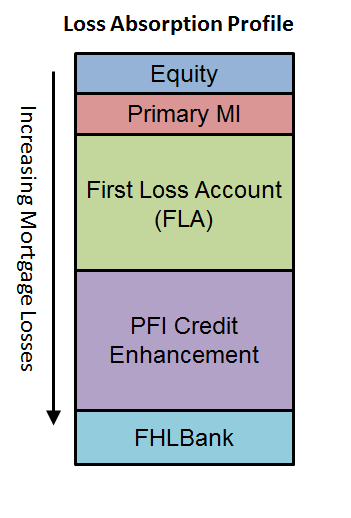

Funding mortgage loans under the MPF 35 product allows your Federal Home Loan Bank (FHLBank) to manage the liquidity, interest rate, and prepayment risks of the loans while you manage the credit risk. MPF 35 establishes the FHLBank First Loss Account at the time of funding and provides you additional income for sharing in the credit risk with your FHLBank. When a loss occurs, the credit risk sharing feature of MPF 35 allocates those losses after borrower equity and private mortgage insurance are depleted through a loss structure designed to share the remaining loan loss between the FHLBank and you.

Features

- Additional income for sharing in the credit risk: A mutually agreed upon amount ranging from 7 basis points (0.07%) up to 14 basis points (0.14%) annualized on the pool of loan balances made up of two components:

-

A fixed rate portion, you have a choice to receive additional up-front income in the price or to be paid the annualized amount monthly beginning the month after delivery; and

- A performance-based portion paid monthly beginning the 13th month after delivery after deducting any losses allocated to the First Loss Account

-

- Remittance Options: Actual/Actual, Actual/Actual Single Remittance, and Scheduled/Scheduled

- First Loss Account: 35 basis points of the principal amount of the Mortgage Loans funded under a Master Commitment at the time of funding

- Servicing Fees: 25 basis points (0.25%) annualized, paid monthly

- Delegated Underwriting; DU and LPA maybe used to assist in making the underwriting decision

Benefits

- No loan-level price adjustments

- Additional income for quality loans

- Competitive execution

- Same-day delivery and funding

- Servicing-released options available

Actual/Actual Remittance features a remittance option similar to agency actual/actual, with monthly reporting and competitive up-front price. This option is structured so that Servicers transfer funds to their FHLBank non-interest bearing custodial deposit account whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Frequency – Whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

- Non-interest bearing custodial P&I account maintained at the FHLBank

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount

- Scheduled P&I, less a servicing fee (remitted the current month)

- Unscheduled principal (curtailments and payoffs remitted the month following receipt);

- 30-days interest expense on payoffs and curtailments

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the 18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

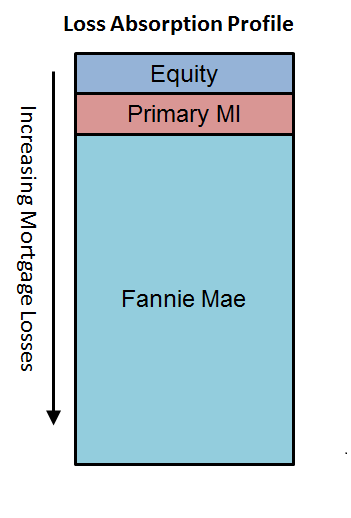

With membership comes rewards. Sell us your fixed-rate, conforming loans and we will resell those loans through our partnership arrangement to Fannie Mae. This product does not include risk-sharing which means no collateral or risk-based capital requirements. When taking advantage of the MPF Xtra product, you have the flexibility to:

- Sell into the secondary market without the additional approval and fees

- Retain the servicing rights, earn servicing fee income, and preserve the ability to cultivate and maintain relationships with customers, or

- Sell the servicing rights and receive a servicing-released premium.

Features

- LTV ratios up to 97%

- Occupancy:

- Owner-occupied

- Second homes and investment properties

- HomeReady® purchase transactions for first-time home buyers

- DU® Validation Services (Income, Employment and Asset Validation) and Appraisal Waivers are available

- RefiNow: refinance aimed to assist low-income borrowers by reducing monthly housing payment, build equity and grow wealth

- Delegated Underwriting; DU maybe used to assist in making the underwriting decision

Benefits

- Competitive execution

- Mandatory and Best Efforts Delivery Commitments available

- Low loan balance pricing pay ups

- Retention of borrower relationships

- Access to Fannie Mae technology

- Desktop Underwriter (DU®)

- Collateral Underwriter (CU®)

- Day 1 Certainty

Best Efforts Delivery Commitment

Best Efforts Delivery Commitments are available under all of the MPF Xtra product offerings. Federal Home Loan Bank (FHLBank) PFIs are able to take advantage of the MPF Xtra product, which offers:

- The transfer of interest-rate and prepayment risks as well as the credit risk of the associated loans to an investor

- Delivery Commitments under a Best Efforts option for individual loans, with no pair-off fees if loan does not close

- Retention of the servicing rights and servicing fee income, preserving the ability to cultivate and maintain

Who Should Take Advantage of this Option?

MPF Xtra Best Efforts Delivery Commitments are for any seller that is actively engaged in mortgage lending in its community, has a high regard for the value of customer relationships, and seeks to more effectively manage its origination pipeline. If the associated loan closes, you must deliver that loan under the Delivery Commitment; however, there is no pair-off fee assessed if the loan does not close and the Delivery Commitment expires. You gain greater access to secondary market liquidity and minimize the associated interest rate risk due to market changes.

You continue to have the option of manually underwriting the loans or obtain access to Fannie Mae's Desktop Underwriter (DU). Utilizing DU reduces a PFI's loan origination representations and warrants to the investor. PFIs may utilize DU Validation Services (income, employment, and asset validation) and property inspection waiver features.

Benefits

- Receive a competitive execution with delivery flexibility

- Enhance pipeline management tools

- Reduce exposure to interest rate fluctuations

*The FHLBanks do not provide accounting or legal advice with respect to the accounting treatment of MPF® Program assets and liabilities. The participating member is expected to consult with its own accountants and attorneys for advice on this matter.

Actual/Actual Remittance features an investor reporting and remittance option similar to agency actual/actual and a competitive up-front price. This option is structured so that Servicers wire or ACH funds to the FHLBank Chicago's non-interest bearing custodial account and deposit funds by 2:00 C.S.T the day following the receipt of principal and interest payment net of servicing fees. Servicers will find the actual/actual remittance particularly attractive if they are knowledgeable in actual/actual investor reporting and they value the ease of operation, they value the up-front price benefit and they are knowledgeable in actual/actual investor reporting.

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – 22nd of each month or prior business day if 22nd falls on the weekend or holiday

- Investor Reporting – Daily

-

Remittance Frequency – The Servicer must deposit all funds into their designated P&I Custodial Account by 2:00pm Central Standard Time the next Business Day following the Servicer’s receipt of the funds.

- Non-interest bearing custodial P&I account maintained at the FHLBank Chicago. Note: Under MPF Xtra the PFI is to deposit the P&I funds into a clearing account at their institution and immediately remit the funds into their account at FHLB Chicago.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®