Quality Control

The MPF Program’s Quality Control (QC) department performs post-funding reviews on Mortgage Loan Files to verify they meet the definition of investment quality, comply with the MPF Guides and the Applicable Agreements. Please refer to the MPF Guides for complete QC details.

eMAQCSplus is a web-based, easy-to-use portal for the secure upload of loan files requested for various types of MPF Quality Control reviews. eMAQCSplus also includes functionality for managing and reporting on your pipeline.

PFIs and Servicers are required to visit the eMAQCSplus webpage to obtain log-in credentials and sign up to receive email notifications.

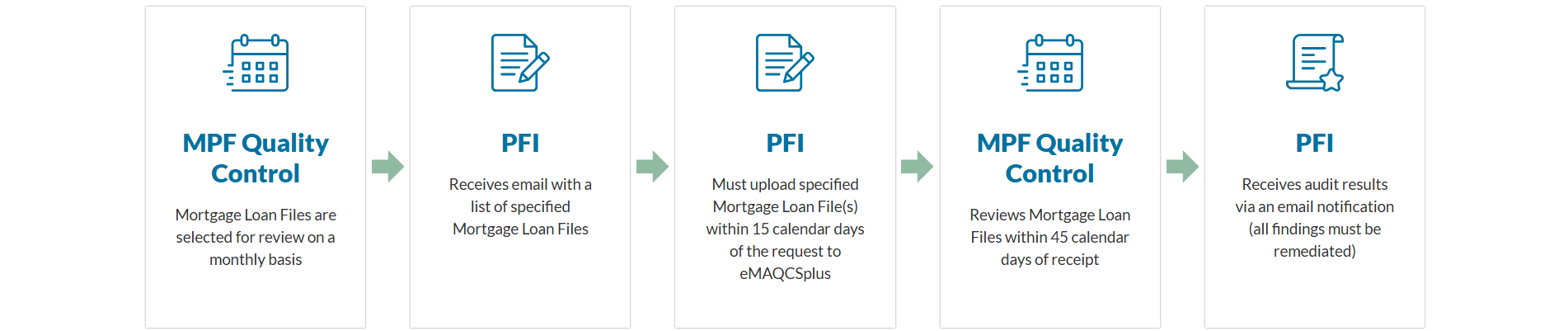

Origination Quality Control Review Process Flow

On a monthly basis the MPF Quality Control department selects a sample of MPF Mortgage Loans for review utilizing the eMAQCSplus website.

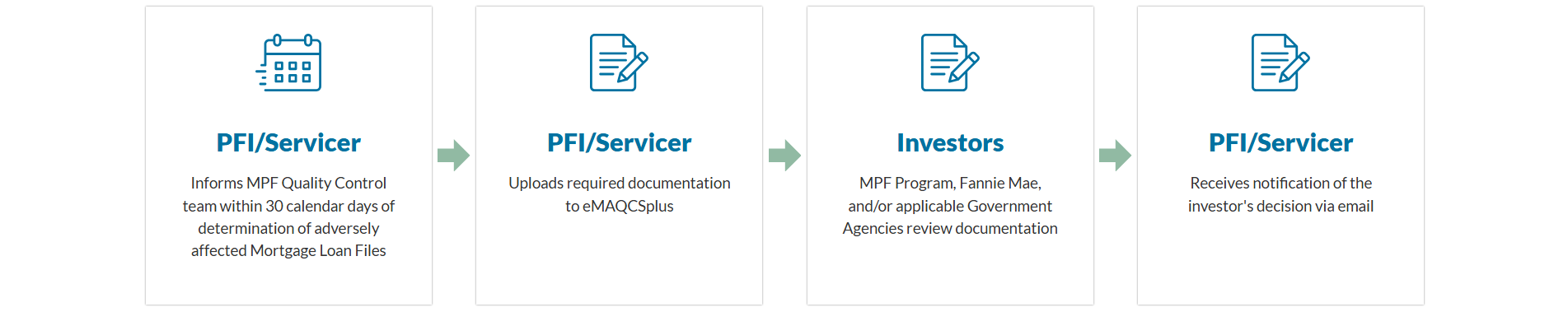

PFIs/Servicers Self Reporting

PFIs/Servicers are required to inform the MPF Service Center of all post-funding QC findings that adversely affect the investment quality or eligibility of a Mortgage Loan File. Any incident of suspected fraud or false representation, as defined under the Financial Crimes Enforcement Network (FinCEN) anti-money laundering and Bank Secrecy Act (BSA) regulations, must be reported immediately to the MPF Service Center ([email protected] or MPF Customer Service Portal).