MPF Announcement 2024-62

MPF Xtra – Delinquent Reporting Update

Effective Date: Immediately (unless otherwise noted within)

The MPF Program is reminding Servicers of additional reporting requirements and communicating updates to the MPF Xtra Supplemental Data excel file.

In efforts to help Servicers with delinquency management enclosed is a job aid providing Servicers additional guidance and instructions related reporting and Borrower outreach requirements.

MPF Xtra Supplemental Data Reminders

Servicers are reminded that for all MPF Xtra mortgage loans that are reported as 30+ days delinquent reporting Action Codes 0 (No Action), 12 (Relief Provision), or 20 (Loss Mitigation) on their monthly Exhibit B: Delinquent Mortgage & Bankruptcy Status Report are subject to requests for additional data.

The request for additional data is distributed to Servicers via automated emails from eMAQCS®plus and include an MPF Xtra Supplemental Data excel attached. Servicers must submit the MPF Xtra Supplemental Data file to the MPF Provider by uploading the file to eMAQCSplus within 5 business days.

Updates to the MPF Xtra Supplemental Data File

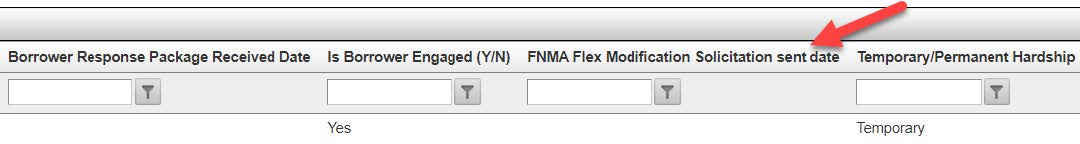

To ensure Servicers are soliciting Borrowers in accordance with Investor requirements, effective September 18, 2024, the MPF Xtra Supplemental Data excel file has been updated to collect data specific to Flex Modification Solicitations that are required between the 90th day and 105th day of delinquency.

To ensure Servicers are soliciting Borrowers in accordance with Investor requirements, effective September 18, 2024, the MPF Xtra Supplemental Data excel file has been updated to collect data specific to Flex Modification Solicitations that are required between the 90th day and 105th day of delinquency.

As a reminder, pursuant to Investor requirements, Servicers must send the Borrower a solicitation package for a workout option:

- If the Servicer has not achieved QRPC or obtained a resolution to the delinquency by the 45th day of delinquency, as outlined in D2-2-04 Sending a Borrower a Solicitation Package for a Workout Option.

- If the solicitation requirements in D2-3.2-06, Fannie Mae Flex Modification are met, the Servicer must solicit the Borrower for a Fannie Mae Flex Modification between the 90th and 105th day of delinquency.

Servicers must report to the MPF Provider the dates for which the solicitations are sent to the Borrower by using the MPF Xtra Supplemental Data File.

Please reference the below image, which highlights the new required field.

As a reminder, for assistance with questions related to this enhancement, Exhibit B submissions, eMAQCSplus, and Default Management, Servicers should contact the MPF Service Center at 877-FHLB-MPF (877-345-2673) or MPF-Help@fhlbc.com, and utilize the call option for Default Management related questions (option 3).

Job Aid: MPF Xtra Servicers Delinquency Management Reminders

The below is an informational timeline to assist Servicers with delinquency management. For detailed guidance Servicers must refer to Chapter 8 of the MPF Xtra Servicing Guide and the applicable Fannie Mae guide sections.

Servicers are also encouraged to view the MPF Xtra Product: Default Servicing Additional Data Requests On-Demand Webinar which outlines the reporting enhancement and the steps that need to be taken when a request for more information is received.

- 30th day of delinquency or greater – Delinquency Reporting: Servicers must report the appropriate delinquency status code that best describes the latest action the Servicer has taken to manage a delinquency. For further guidance reference the following:

- 36th day of delinquency – Quality Right Party Contact: Servicers must follow the outbound contact attempt requirements outlined by Fannie Mae in D2-2-02 Outbound Contact Attempt Requirements | Fannie Mae.

- 45th

day of delinquency – Borrower Solicitation* Letter:

If the Servicer has not achieved QRPC or obtained a resolution to the

delinquency by the 45th day of delinquency, the Servicer must send either

a Borrower Solicitation Letter (Form 745), or equivalent, or a

Borrower Solicitation Package.

- Servicers are required to report the dates the Borrower Solicitations were sent to the Borrower by using the MPF Xtra Supplemental Data Excel and must submit all applicable Borrower Workout requests in eMAQCSplus.

- D2-2-04 Sending a Borrower a Solicitation Package for a Workout Option

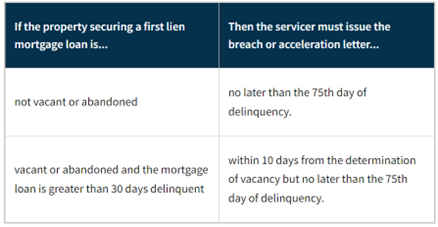

- 75th day of delinquency – Breach Letters: Servicers must issue the breach or acceleration letter as outlined in D2-2-06 Sending a Breach or Acceleration Letter including:

90th day of delinquency – Flex Modification Solicitation*: Between the 90th day and 105th day of delinquency Servicers must:

- Solicit the Borrower for a Fannie Mae Flex Modification: If the solicitation requirements outlined in in D2-3.2-06, Fannie Mae Flex Modification are met, Servicers must solicit a Borrower for a Fannie Mae Flex Modification.

- Servicers are required to report all Borrower solicitations to the MPF Provider using the MPF Xtra Supplemental Data Excel.

- Submit Fannie Mae Flex Modifications

requests to the MPF Provider: If the Servicer

determines the Borrower is eligible for a Fannie Mae Flex Modifications,

Servicers are required to submit Fannie Mae Flex Modification request in

eMAQCSplus using the Evaluate – Flex Modification (FLEX) option

under SMDU Forms.

- Servicers should refer to Exhibit Z-X: MPF Xtra Flex Modification (FLEX) Request – Instructions for additional guidance.

- The MPF Provider will review the request

in SMDU and provide the Servicer with a decision, then the Servicer can

send the solicitation to the Borrower for review and acceptance.

*Note: There are two separate solicitation requirements as outlined above. The first being the Borrower Solicitation for a workout option required at the 45th day of delinquency and the second being the Flex Modification required between the 90th-105th day of delinquency. Servicers must report the dates for which the solicitations are sent must be reported on the MPF Xtra Supplemental Data File each time the Servicer solicits to the Borrower.

Helpful Hints:

- If Servicers need access to eMAQCSplus, please use the following link to gain access: eMAQCs Plus log-in instructions

- Servicers must make every attempt to achieve Quality Right Party Contact (“QRPC”) with Borrowers about resolution of a mortgage loan delinquency as soon as required or permitted under Applicable Laws. Including taking reasonable steps to secure contact with Borrowers who are non-responsive, such as: skip tracing, updating contact information often, attempting contact by mail, phone, and door knocking where applicable.

- The Exhibit B: Delinquent Mortgage & Bankruptcy Status Report and MPF Xtra Supplemental Data File must accurately reflect all actions taken by the Servicer.

- Servicers are responsible for selecting qualified, experienced law firms for all jurisdictions to handle default-related legal services relating to MPF Xtra mortgage loans pursuant to Fannie Mae’s requirements. For additional information refer to F-2-04, Firm Minimum Requirements.

- References:

- MPF Announcement 2024-62

.png?sfvrsn=1873511c_1)