MPF Traditional Servicing – Determining Loan Modification Terms

Effective Date: Immediately (unless otherwise noted within)

The MPF Program is updating the steps for determining the terms for a loan modification for MPF Traditional Conventional mortgage loans.

The updated steps to determining the loan modification terms expand eligibility by revising the mark-to-market loan-to-value (MTMLTV) based requirements, provide more equitable payment reduction to eligible borrowers by applying the terms incrementally, and targeting a 20% P&I payment reduction.

Effective Date: Servicers may immediately start determining the borrower’s new modified mortgage loan terms according to the requirements outlined in the attached Exhibit A but are required to implement the changes no later than April 1, 2025.

Exhibit A to this MPF Announcement reflects the guideline updates to the applicable MPF Traditional Servicing Guide sections. These policy changes will be reflected in an MPF Traditional Servicing Guide update at a later date.

Please contact the MPF Service Center with any questions or concerns via email at [email protected] or by calling (877-FHLB-MPF).

Exhibit A

NOTE: The following updates will replace the referenced Guide section in its entirety upon the effective date described above. While only the steps for determining the new modified mortgage loan terms are being updated, Servicers must refer to all other applicable sections in the MPF Traditional Servicing Guide when evaluating a Borrower for a loan modification.

9.2.4.6.2 Determining New Modified Loan Terms

To determine the borrower's new modified mortgage loan terms, the Servicer must determine the post-modification mark-to-market loan-to-value (“MTMLTV”) ratio, which is defined as the gross UPB of the mortgage loan including capitalized arrearages, divided by the current value of the property.

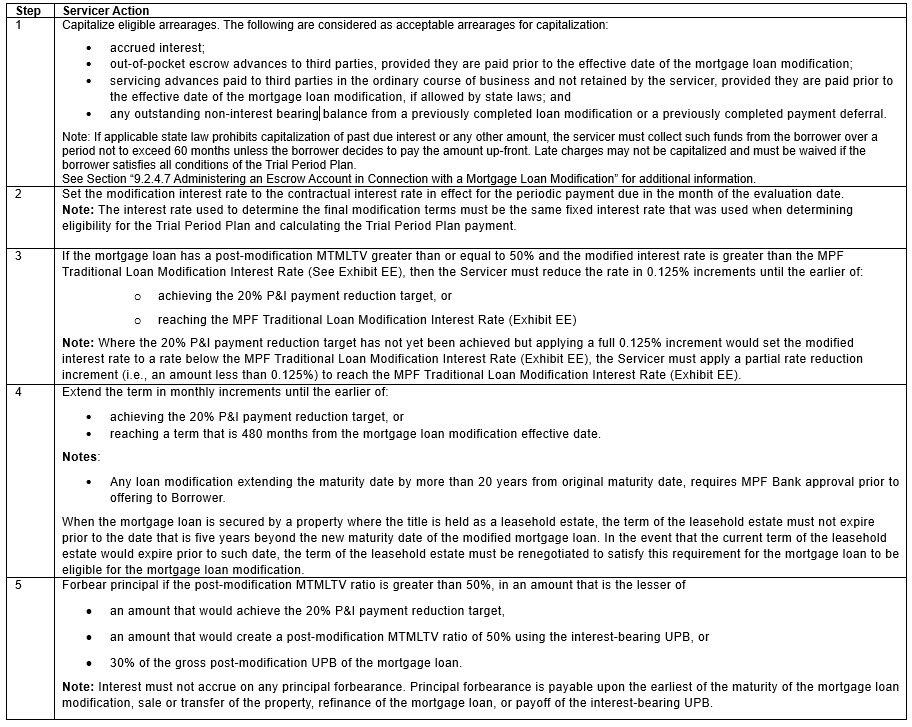

The servicer must complete all the steps in the order shown in the following table, unless prohibited by applicable law, to determine the borrower's new modified mortgage loan terms, until the earlier of:

- achieving a 20% P&I payment reduction target (i.e. applying the increment or amount as described in each step of the following table to result in a payment reduction that exceeds but is as close as possible to 20% (e.g., 20.01%)); or

- exhausting the steps for determining the modification terms.

Servicers are strongly encouraged to use Form SG357 Permanent Loan Modification Worksheet, or its equivalent, to determine the loan modification terms, as Servicers are required to submit that worksheet with the SG354.

The servicer must request MPF Bank’s prior written approval by submitting a request through eMAQCSplus to deviate from the prescribed steps for determining the new modified mortgage payment terms, unless a certain step is prohibited by applicable state law.

If the steps are exhausted without achieving the 20% P&I payment reduction target, then the Servicer must offer the resulting terms to the Borrower provided the Loan Modification must result in a fixed rate mortgage loan with a monthly P&I payment that is:

- less than the borrower's pre-modification P&I payment, if, at the time of evaluation, the mortgage loan is current or less than 31 days delinquent or

- less than or equal to the pre-modification P&I payment, if, at the time of evaluation, the mortgage loan is 31 or more days delinquent.

Prior to granting a permanent mortgage loan modification, the Servicer must place the borrower in a Trial Period Plan using the new modified mortgage loan terms. See 9.2.4.8 Offering a Trial Period Plan and Completing a Loan Modification.

Servicers are required to ensure that the loan is not falling out on their TAR (Turn Around Report) and that their Monthly Summary and Remittance Report (SG300) reflects the correct loan level data (including UPB) Servicer is relying on to determine eligibility. Loan Level discrepancies require resolution prior to completing a Loan Modification. See Section “2.13.1 Monthly Accounting Reports.”

Servicers are strongly encouraged to use the Loan Modification Worksheet (see attachment to Form SG354) when determining the modified terms, to ensure the proper amounts are being considered, as that worksheet will be required to be submitted with the Form SG354 once the loan modification is finalized.