MPF® Government

The MPF Government product allows you to sell fixed-rate mortgage loans that are insured or guaranteed by government agencies to your local Federal Home Loan Bank (FHLBank).

Product Details

The loan programs that can be sold under the MPF Government product include:

- FHA Low down payment options

- VA Financing and down payment flexibility for military veterans

- RHS Section 502 Flexible financing for borrowers in rural and agricultural areas

- HUD Section 184 Affordable and flexible financing on Indian/Native American land

The MPF Government product offers you the flexibility to retain the servicing of loans sold to your FHLBank or take advantage of our servicing-released option. When choosing the servicing-released option, you would receive a competitive servicing-released premium from the MPF Program's approved servicing aggregator.

Use MPF Government if:

- You are looking for a competitively-priced government loan investor

- You are approved by the applicable government agency to originate and service loans

- You want a variety of mortgage loan options to meet the needs of your customers

- You appreciate having maximum flexibility in choosing your servicing and remittance option

How it Works

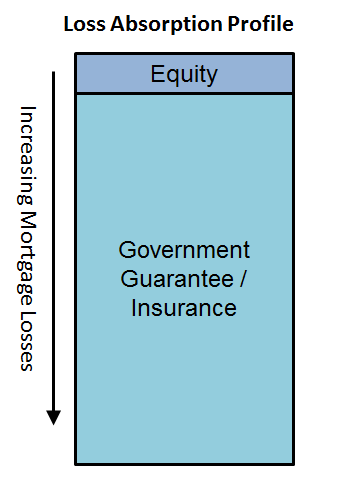

When selling government loans to your FHLBank, the FHLBank manages the liquidity, interest rate, and prepayment risks of the loans. The PFI is responsible for obtaining the applicable government insurance or guarantee, following all agency guidelines and requirements, closing the loan with the borrower, and selling the loan to their FHLBank.

Benefits

- Competitive servicing retained execution

- Choice of remittance options

- Excellent servicing released execution

- All-in execution = Asset Price + SRP

- Same-day loan delivery and funding

- Depository institutions have no leverage capital or risk-based capital requirements for loans sold under the MPF Government product.*

- Delegated Underwriting; DU and LPA maybe used to assist in making the underwriting decision

*The FHLBanks do not provide accounting or legal advice with respect to the accounting treatment of MPF Program assets and liabilities. The participating member is expected to consult with its own accountants and attorneys on this matter.

Community Lenders Share Their Experience

Remittance Options

Actual/Actual Remittance features a remittance option similar to agency actual/actual, with monthly reporting and competitive up-front price. This option is structured so that Servicers transfer funds to their FHLBank non-interest bearing custodial deposit account whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

Characteristics

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Frequency – Whenever the balance of the P&I Custodial Account (excluding Servicing Fees) exceeds $2,500 and then any remaining account balance on the first business day of the month after the accounting cut-off date.

Requirements

- Non-interest bearing custodial P&I account maintained at the FHLBank

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount – Actual P&I collections, less a servicing fee

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

- Remittance Amount

- Scheduled P&I, less a servicing fee (remitted the current month)

- Unscheduled principal (curtailments and payoffs remitted the month following receipt);

- 30-days interest expense on payoffs and curtailments

- Accounting Cut-Off Date – Falls on the last business day of calendar month

- Investor Reporting – Reports submitted by the fifth business day following the accounting cut-off

- Remittance Date – The 18th calendar day of the month following the accounting cut-off. If the 18th falls on a weekend or holiday the remittance day is the business day prior to the 18th.

- Electronic investor-reporting (using either an Excel or ASCII file)

- Access to the MPF Master Servicer's secure website, ServicerConnect®

MPF® Government MBS

MPF Government MBS allows approved lenders to sell fixed-rate government loans (FHA, VA, RHS Section 502) to the Federal Home Loan Bank of Chicago. These loans are then pooled into securities guaranteed by Ginnie Mae.

Benefits include competitive pricing, a variety of loan options, and scheduled/scheduled remittance servicing.

View MBSConventional / Conforming Loans

MPF Program offers conventional conforming loans with flexible remittance options to help manage liquidity and risk.

View LoansExplore More Resources

Access resources, including guides, articles, and announcements, to stay informed about the MPF® Program.

MPF Guides

Dive deeper into the program with our comprehensive program and product guidelines.

Knowledge Articles

Expand your understanding with our curated collection of informative articles.

MPF Program Updates

Stay up-to-date with the latest program news, updates, and important deadlines.