1Chapter 1: Introduction

Last Updated: Dec 20, 2024

1.11.1 MPF Government MBS Overview (12/20/24)

Under the MPF Government MBS product, the Federal Home Loan Bank of Chicago (“MPF Provider”) purchases eligible government insured and guaranteed mortgage loans from PFIs and holds the loans on its balance sheet for a period of time before issuing securities guaranteed by Ginnie Mae (GNMA), backed by a pool of MPF Government MBS mortgages. GNMA looks to the MPF Provider as the Issuer, to ensure all GNMA standards are met, including those pertaining to loan pooling eligibility, servicing and MBS bond administration, handling of funds, and reporting on loan performance. As a result, the MPF Provider requires PFIs and Servicers to ensure all applicable GNMA standards are met, as is more fully provided for in the applicable MPF Guides and Applicable Agreements.

Unless otherwise provided for in an MPF Guide, whenever PFIs/Servicers have any questions or concerns, or are directed in an MPF Guide to contact the MPF Provider, to notify MPF Provider, to submit something to MPF Provider, this should be done by contacting the MPF Service Center through the MPF Customer Service Portal or contacting MPF Service Center ([email protected] or 877.345.2673). Contact information for the MPF Banks, MPF Provider, Master Servicer, MPF Program Custodian, and MPF Government MBS Custodian, can be found in the MPF Directory (Exhibit T).

1.21.2 Applicability of MPF Government MBS Guides

The MPF® Government MBS Selling Guide (“Selling Guide”), the MPF Program Guide, the MPF Government MBS Servicing Guide, product specific manuals, forms, exhibits, (together referred to herein as the “Guides”), and the Applicable Agreements apply to all Participating Financial Institutions (PFIs) and Servicers originating, delivering or servicing MPF Government MBS Mortgage Loans. This Selling Guide outlines the requirements and/or processes PFIs must follow to originate, underwrite, and deliver MPF Government MBS Mortgage Loans under the MPF Program. All MPF Government Mortgage Loans delivered under the MPF Program must meet these guidelines. PFIs must abide by the procedures, terms, and conditions set forth in this Selling Guide, as it may be amended from time to time. In the event of a conflict between the Selling Guide and applicable Government Agency requirements or Ginnie Mae MBS Guide requirements, the most restrictive requirement will apply.

For any topics not addressed in the Guides, including the MPF Program Guide, the MPF Government MBS Selling Guide, and the MPF Government MBS Servicing Guide, PFIs and Servicers must follow the requirements of the applicable Government Agency guides and the GNMA MBS Guide.

PFIs and Servicers are required to have policies and procedures that ensure they are aware of and timely implement any and all updates made by the MPF Program, applicable Government Agencies, and GNMA to any applicable guides, guidance or agreements.

Failure of a PFI to perform its obligations under either the Applicable Agreements or the Guides constitutes an Event of Default entitling the MPF Provider or MPF Bank to exercise all available remedies as provided in the Guides and Applicable Agreements.

1.31.3 PFI Eligibility

To sell MPF Government MBS Mortgage Loans to the MPF Provider, in addition to the PFI eligibility requirements of the Guides, a PFI must meet all the requirements listed below:

- PFI must be approved to originate and/or service mortgage loans (as applicable) by each applicable Government Agency insuring/guaranteeing the mortgage loans they are selling to or servicing for MPF Provider as MPF Government MBS loans, and be in good standing with each such Government Agencies (Note: a PFI approved only as an FHA loan correspondent is not eligible to delivery FHA loans into the MPF Program);

- To the extent that the PFI has been reviewed by a federal mortgage insurance or guaranty agency (i.e. FHA, VA, USDA), the PFI must have received an acceptable assessment during their most recent compliance review (if the PFI has not undergone a such a review, the MPF Bank or MPF Provider may request and evaluate the PFI’s internal QC results, the MPF Provider’s QC results, or choose to assess the PFI’s eligibility with some other reasonable method of evaluation); and

- PFI must not have principals or officers be the subject of any government debarment or HUD program exclusion, or have been subject to any such sanction within the ten (10) years preceding the submission of a request to establish an MPF Government MBS Master Commitment.

1.41.4 Repurchases

PFIs and Servicers are responsible for ensuring all loans they deliver to, or service for, the MPF Program are compliant with all MPF Guide requirements, including applicable Government Agency and Ginnie Mae MBS guide requirements, and with all Applicable Laws, which include without limitation, predatory lending laws. A PFI which purchases loans to be delivered under the MPF Government MBS product is required to take steps to ensure that loans originated by third parties are in compliance with MPF Program requirements and all Applicable Laws, which include without limitation, predatory lending laws.

When a PFI or Servicer fails to comply with the requirements of the PFI Agreement, Guides, Applicable Law or terms of Mortgage Loan documents, the PFI or Servicer may be required to repurchase Mortgage Loans which are impacted by such failure, in addition to covering any related costs or losses incurred by the MPF Provider as a result of holding the Mortgage Loans.

PFI and Servicers do not have a unilateral right to purchase or repurchase Mortgage Loans. The Guides provide specific instances where a PFI or Servicer may purchase or repurchase an MPF loan. Any purchase or repurchase by a PFI or Servicer must be pre-approved by the MPF Provider, and no steps to initiate a purchase or repurchase should be taken without the written approval or consent of the MPF Provider. The PFI/Servicer must submit requests for purchase or repurchase to the MPF Provider by contacting the Service Center. The MPF Provider reserves the right to refuse purchase or repurchase requests that are not specifically permitted in the MPF Guides or Ginnie Mae MBS Guides.

See additional purchase and repurchase requirements in MPF Program Guide Section 3.5 Purchase or Repurchase Requirements, and in the MPF Government MBS Servicing Guide.

1.51.5 Indemnification

PFIs and Servicers shall indemnify and hold harmless: (a) the MPF Bank; (b) the MPF Provider; (c) the Master Servicer; (d) Ginnie Mae; and (e) the officers, directors, employees, agents and affiliates of the MPF Bank, MPF Provider, Master Servicer and Ginnie Mae from and against any and all claims, losses, damages, judgments, penalties and any other costs, fees, and expenses (including reasonable attorneys' fees and court costs) arising out of, based upon, or relating to: (i) a breach by the PFI or Servicer, its officers, directors, employees or agents of any representation, warranty or covenant contained in the Applicable Agreement and the Guides, or any failure to disclose any matter that makes any representation or warranty misleading or inaccurate, or any inaccuracy in material information furnished by the PFI or Servicer; (ii) a breach of any representation, warranty or covenant, failure to disclose, or inaccuracy in information furnished by the PFI or Servicer regarding itself; or (iii) a violation of Applicable Law or MPF Program requirements.

In addition, the PFI or Servicer, as applicable, shall provide legal representation on behalf of the indemnified parties in connection with any legal proceeding involving a Mortgage Loan. Neither an indemnified party nor the holder of a related security shall be liable for any attorneys' fees, court costs or other expenses incurred in connection with such litigation, except to the extent that the attorneys' fees, court costs or other expenses result from the negligence or wrongful misconduct of the party entitled to indemnification. Any judgment against the MPF Bank, MPF Provider, Master Servicer, Ginnie Mae or their officers, directors, employees, agents and affiliates shall be satisfied by the PFI or Servicer, as applicable, as a recoverable advance, except to the extent that the judgment results from the negligence or wrongful misconduct of the party entitled to indemnification.

Related Resources

2Chapter 2: Mortgage Eligibility

Last Updated: Dec 09, 2024

2.12.1 Mortgage Loan Eligibility and Underwriting Requirements

To be eligible for delivery as an MPF Government MBS loan, a mortgage loan must meet the MPF Program’s loan eligibility requirements and it must:

- Comply with the applicable Government Agency’s standards, including loan eligibility and underwriting requirements;

- Comply with Ginnie Mae MBS Guide loan eligibility requirements;

- Comply with all Applicable Laws; (See also MPF Program Guide Chapter 7);

- Be a one-to-four family fully amortizing fixed rate mortgage loan; and

- Be and remain insured or guaranteed until payoff or liquidation of the loan as follows:

- FHA insured Mortgage Loans;

- VA guaranteed Mortgage Loans; or

- RHS Section 502 guaranteed Mortgage Loans.

2.1.12.1.1 Eligible Borrowers

Eligible Borrowers are those established by the applicable Government Agency.

2.1.22.1.2 Eligible Property Types

Eligible property types are one- to- four family units that meet the property eligibility guidelines established by the applicable Government Agency.

2.1.32.1.3 Ineligible Products or Attributes (8/27/24)

- Adjustable rate

- Balloon payments

- HUD 184

- Buydowns

- HPML/Section 32

- Interest only

- Graduated payments

- Negative amortization

- Loans with Prepayment Penalties

- VA Texas 50(a)(6)

- Home Equity Line of Credit (HELOC)

- Mortgage loans not in first lien position

- FHA Tile I

- FHA 203K

- Modified loans (i.e. mortgage loans with material modifications after closing, other than resulting from principal curtailment, that changed any of the loan terms or attributes reflected in the original Note, such as changes to the original loan amount, interest rate, final maturity, or product structure) or re-performing loans

- VA Vendee

- Investment properties

- Co-ops

- Condotels

- Non-warrantable condominiums

- Timeshares

- Manufactured homes

- High LTV VA cash-out refinance loans (LTV >90%)

- VA Refinance Transactions (i.e., Interest Rate Reduction Refinance loan (IRRL), non-IRRL refinances, cash-out refinances, etc.)

2.1.42.1.4 Properties Impacted by a Major Disaster

PFIs are required to follow the applicable Government Agency requirements as to originating loans for properties or borrowers impacted by a Major Disaster.

2.1.52.1.5 Re-Amortized Mortgage Loans

Mortgage loans that are re-amortized due the application of a principal curtailment received from the Borrower are eligible for delivery provided the re-amortization was completed in accordance with the Ginnie Mae Guides and meets the applicable Government Agency requirements. PFIs must include the fully executed re-amortization documentation at the time of delivery to the MPF Program.

2.22.2 Maximum Loan Limits (12/17/25)

The maximum loan limits for MPF Government MBS Mortgage Loans are shown below and represent the maximum permissible loan amount eligible for securitization in 2026 calendar year (i.e., MBS issuance dates January 1, 2026 through December 1, 2026) net of any financed mortgage insurance premium or funding fee as reflected on the Note, unless a lower amount is required by the applicable Government Agency.

| Number of Units | Maximum Original Loan Amount for MPF Government MBS Mortgage Loans (Properties in Contiguous States, District of Columbia & Puerto Rico) | Maximum Original Loan Amount for MPF Government MBS Mortgage Loans (Properties in Alaska, Guam, Hawaii & Virgin Islands) |

|---|

| 1 | $ 832,750 | $ 1,246,125 |

| 2 | $ 1,066,250 | $ 1,599,375 |

| 3 | $ 1,288,800 | $ 1,933,200 |

| 4 | $ 1,601,750 | $ 2,402,625 |

The minimum loan amount for MPF Government MBS Mortgage Loans is $25,000.

2.32.3 Maximum LTV/TLTV

The maximum LTV and TLTV limits for MPF Government MBS Mortgage Loans are those established by the applicable Government Agency.

2.42.4 Additional VA Mortgage Loan Requirements

All VA Mortgage Loans delivered under the MPF Government MBS Product must comply with the following additional requirements:

- The amount of cash down payment plus the amount of available VA guaranty must equal at least 25% of (a) the purchase price of the property, or (b) the Certificate of Reasonable Value (CRV), whichever is less. The funding fee charged by VA must not be included in this calculation. The cash down payment must also include the amount, if any, by which the purchase price exceeds the CRV. Mortgage Loans for the simultaneous purchase of a home and energy conservation improvement are based solely on the CRV amount. The cash down payment may not be derived from a second mortgage on the property.

- The Mortgage Loan amount may exceed the CRV amount only if the VA funding fee is included in the Mortgage Loan and only to the extent of the funding fee. The unpaid Principal Balance of the VA Mortgage Loan may be greater than the current conforming loan limit and still be eligible for delivery under the MPF Government MBS product.

- If there are co-Borrowers on a Mortgage Loan (other than a spouse) and one or more of the Borrowers do not have VA eligibility (i.e., veterans/non-veterans joint mortgages) the Mortgage Loan is eligible to be delivered under the MPF Government MBS Mortgage product if the 25 percent requirement of VA guaranty plus cash/equity is met. The cash requirement may be satisfied by either cash or “equity” which is the positive difference between the amounts specified in the CRV and the new Mortgage Loan amount.

2.52.5 Government Loan Streamline Refinance and Cash-Out Refinance (8/27/24)

Cash-out refinance loans such as FHA streamlined refinance loans, and RHS streamlined refinance loans are eligible for delivery under the MPF Government MBS product, provided that they comply with all MPF Program and applicable Government Agency requirements for Government Loans, and MPF Government MBS seasoning requirements. VA Refinance transactions are not eligible for delivery at this time.

For cash-out refinance loans and streamlined refinance loans:

- the borrower must have made at least six (6) consecutive monthly payments on the loan being refinanced, beginning with the payment made on the first payment due date; and

- the first payment due date of the refinanced loan occurs no earlier than 210 days after the first payment due date of the initial loan.

Documentation supporting the payment activity on the previous loan must be maintained in the Mortgage Loan File.

For all Government Mortgage Loan streamline refinances, Borrower and Co-Borrower income must be collected and delivered for the purpose of Loan Presentment, regardless of the requirements of the Government Agency that insures or guarantees the loan. The MPF Program does not require the income be used to qualify the Borrower(s) if the Government Agency does not require its use for qualification purposes.

2.62.6 Permitted Underwriting Methods

This section contains guidance for underwriting methods to be used for Government Mortgage Loans.

2.6.12.6.1 FHA Mortgage Loans

FHA Mortgage Loans may be underwritten manually in compliance with the requirements of the MPF Selling Guide as well as FHA requirements, or underwritten using DU or LP as described below.

2.6.1.12.6.1.1 DU Underwritten FHA Mortgage Loans

Any FHA Mortgage Loan underwritten using DU must comply with the following requirements:

- DU for FHA Mortgage Loans must include the Underwriting Findings report(s) in the file;

- All conditions and requirements identified through DU must be included in the file; and

- Files must be packaged in accordance with FHA published requirements.

Any FHA Mortgage Loan underwritten using DU must comply with the terms of the FHA Lenders Handbook and Fannie Mae’s Desktop User Guide.

Any FHA Mortgage Loans underwritten using DU, except a Streamline Refinance and assumption, must be scored through TOTAL Mortgage Scorecard. TOTAL Mortgage Scorecard is not an AUS, but a scorecard that interfaces with an AUS such as DU, and provides a Feedback Certificate/Finding Report. The TOTAL Mortgage Scorecard Feedback Certificate/Finding Report used in the underwriting decision must be included in the FHA case binder. All data entered into the AUS must be verified as accurate and complete, and the entire mortgage application must comply with all FHA requirements.

2.6.1.22.6.1.2 LP Underwritten FHA Mortgage Loans

Any FHA Mortgage Loans underwritten using LP must comply with the following requirements:

- LP files must include:

- Loan Prospector Feedback Certificate;

- All documents as indicated by the Loan Prospector Feedback Certificate, including all conditions; and

- Indication of “Freddie Mac LP” on the completed loan submission summary report.

Any FHA Mortgage Loan, except a Streamline Refinance and assumption, must be scored through TOTAL Mortgage Scorecard. TOTAL Mortgage Scorecard is not an AUS, but a scorecard that interfaces with an AUS such as LP, and provides a Feedback Certificate/Finding Report. The TOTAL Mortgage Scorecard Feedback Certificate/Finding Report used in the underwriting decision must be included in the FHA case binder. All data entered into the AUS must be verified as accurate and complete, and the entire mortgage application must comply with all FHA requirements.

2.6.22.6.2 VA Mortgage Loans

VA Mortgage Loans may be underwritten manually in compliance with the requirements of the MPF Selling Guide as well as VA requirements or underwritten using DU or LP as described below.

2.6.2.12.6.2.1 DU Underwritten VA Mortgage Loans

Any VA Mortgage Loan underwritten using DU must comply with the terms of the VA Lenders Handbook and Fannie Mae’s DU requirements.

Any VA Mortgage Loan underwritten using DU must include the Underwriting Reporting in the Mortgage Loan File as well as meet all conditions and requirements identified by DU.

2.6.2.22.6.2.2 LP Underwritten VA Mortgage Loans

Any VA Mortgage Loan underwritten using LP must comply with the terms of the VA Lenders Handbook and the Freddie Mac LP requirements.

LP files must include:

- Loan Prospector Feedback Certificate;

- All documents as indicated by the Loan Prospector Feedback Certificate, including all conditions; and

- Indication of “Freddie Mac LP” on the completed loan submission summary report.

2.72.7 Government Mortgage Insurance

Government Mortgage Loans must maintain the insurance or guaranty from the applicable Government Agency. If any premium is not paid to the Government Agency when due, or if the insurance or guarantee is canceled by the Government Agency for any reason, the MPF Provider or MPF Bank may:

- Require repurchase of the Mortgage Loan; or

- Advance the premium or behalf of the PFI and debit the PFI’s DDA for the amount of the advance.

Related Resources

5Chapter 5: Master Commitments

Last Updated: May 27, 2025

This chapter describes the requirements for establishing, filling, and closing a Master Commitment.

5.15.1 Master Commitment Overview

A Master Commitment is an agreement between the PFI and the MPF Bank which defines the terms under which the MPF Bank will purchase a pool of Mortgage Loans delivered by the PFI. A Master Commitment must be completed and signed by an authorized party of the PFI in accordance with the PFI Agreement, and must be signed as accepted by the MPF Bank. All MPF Government MBS Master Commitments are assigned to the MPF Provider, requiring PFIs to sell MPF Government MBS mortgage loans to the MPF Provider.

The signing of a Master Commitment does not require the PFI to originate or sell any mortgages under the agreement, but it does constitute the PFI’s best efforts commitment to deliver mortgages to the MPF Provider. The MPF Provider reserves the right to limit the number and/or total dollar amount of Master Commitments.

5.25.2 Establishing a Master Commitment

Master Commitments must be established for each distinct Mortgage Loan type and distinct remittance type.

When establishing a Master Commitment, the PFI and the MPF Bank, or MPF Provider must determine and/or be aware of the following:

- The estimated number and dollar amount of Mortgage Loans it believes it will deliver to the MPF Provider over the term of the Master Commitment (The estimated dollar amount of Mortgages will be shown as the amount of the Master Commitment);

- The remittance type for the Master Commitment (actual/actual, actual/actual single remittance or scheduled/scheduled);

- The initial term of the Master Commitment (the term must be at least three (3) months and, at the discretion of the MPF Bank, may be up to five years with a renewal term of up to an additional five years); and

- Whether Servicing of the Mortgage Loans will be retained, or sold concurrently with the sale of Mortgage Loans.

The following combinations of Mortgage Loan types are not allowed within the same Master Commitment and require separate Master Commitments:

- Conventional Loans may not be combined with Government Loans;

- HUD Section 184 loans may not be mixed with any other Government or Conventional Loans;

- RHS Section 502 loans may not be mixed with any other Government or Conventional Loans; and

- Remittance types (actual/actual, actual/actual single remittance, and scheduled/scheduled) may not be combined.

5.35.3 Filling a Master Commitment

The Master Commitment gets filled when Delivery Commitments are obtained under the Master Commitment and when Mortgage Loans are delivered under the Delivery Commitments.

The PFI must assign each Delivery Commitment to a specific open Master Commitment. A Master Commitment is open for the issuance of a new Delivery Commitment as long as the sum of open Delivery Commitments and the Mortgage Loans already delivered under the Master Commitment is less than the Master Commitment amount.

5.45.4 Amending a Master Commitment

The PFI may request that the MPF Bank amend an open Master Commitment at any time. Any Master Commitment amendment made by the MPF Bank will be made at the MPF Bank's sole discretion.

Amendments may be requested to:

- Change the size and term of the Master Commitment; or

- Extend the expiration date of the Master Commitment.

Amendment requests are subject to the following conditions:

- Requests for amendments must be accompanied by complete information and supporting data;

- No request for amendment may be made which would affect a Mortgage Loan or Delivery Commitment already assigned to a specific Master Commitment.

5.55.5 Closing a Master Commitment

A Master Commitment is closed when any of the following occurs:

- The sum of open Delivery Commitments and the Mortgage Loans delivered under the Master Commitment equals or exceeds the Master Commitment amount; or

- The Master Commitment term has expired.

6Chapter 6: Delivery Commitments

Last Updated: May 27, 2025

This chapter describes the requirements for establishing, filling, and closing a Delivery Commitment.

6.16.1 Overview

A Delivery Commitment is an agreement between the PFI and the MPF Bank and MPF Provider that defines the Note Rate, premium or discount, closing time interval, product type, total dollar amount, and other terms pertaining to the purchase of Mortgage Loans under the terms of the corresponding Master Commitment.

All MPF Government MBS related Delivery Commitments are mandatory and may be filled with a single Mortgage Loan or multiple Mortgage Loans.

A Delivery Commitment cannot be assigned to a closed Master Commitment, nor reassigned to another Master Commitment.

6.26.2 Establishing a Delivery Commitment

By 8:30 A.M. Central Time each Business Day, the MPF Provider will publish electronically on the eMPF® Website, the Rate and Fee Schedules for each remittance type, if available from the MPF Bank and MPF Provider. Each individual Rate and Fee Schedule posted will have a unique schedule number.

Posted Rate and Fee Schedules expire at 3:30 P.M. Central Time on the date of issue. The MPF Provider may cancel, withdraw and/or reissue the Rate and Fee Schedules at any time during the Business Day. Each new issue of a Rate and Fee Schedule will be assigned a new unique schedule number and will be published electronically as indicated above.

The Rate and Fee Schedules posted directly by the MPF Provider on the eMPF Website provide indicative pricing and do not constitute an offer by the MPF Bank to the PFI for a Delivery Commitment.

At any time between 8:30 A.M. Central Time and 3:30 P.M. Central Time, the PFI may obtain a Delivery Commitment using the following methods:

- For Delivery Commitments less than $10 Million, the PFI may utilize the eMPF Website; or

- For Delivery Commitments greater than or equal to $10 Million, the PFI must contact the MPF Servicer Center. All telephone conversations relative to obtaining a Delivery Commitment will be tape-recorded.

The PFI will supply the following information to the MPF Provider:

- PFI name and number (if via telephone);

- The name of the person calling and authorized to obtain a Delivery Commitment (if via telephone);

- The number of the Master Commitment to which the Delivery Commitment is to be assigned;

- The Rate and Fee Schedule number, and associated product type and delivery period;

- The Note Rate for the Delivery Commitment; and

- The Delivery Commitment amount.

The PFI is required to make specific representations and warranties when requesting a Delivery Commitment for certain MPF Mortgage Products.

The MPF Provider will verify the following information:

- The referenced Rate and Fee Schedule is still valid; and

- The referenced Master Commitment is open and the remaining amount equals or exceeds the amount of the Delivery Commitment.

If the above items are confirmed, the MPF Provider will assign a Delivery Commitment number and issue a binding Delivery Commitment. The terms of each Delivery Commitment will be confirmed with the PFI on the day of issuance via on-screen notification and e-mail.

6.2.16.2.1 Note Rate Range

For each MPF Government MBS Delivery Commitment, all the associated Note rates included must be provided in one-eighth percent increments (0.125%) at the time the Mortgage Loans are delivered to the MPF Provider by the PFI.

Note Rate

(X denotes any integer) | Note Rate Change (see MPF Government MBS Selling Guide section 3.2.4 for acceptable increments) |

|---|

| X.000% | Minus (-) 0.250% and Plus (+) 0.125% |

| X.125% | Minus (-) 0.375% and Plus (+) 0.000% |

| X.250% | Minus (-) 0.000% and Plus (+) 0.375% |

| X.375% | Minus (-) 0.125% and Plus (+) 0.250% |

| X.500% | Minus (-) 0.250% and Plus (+) 0.125% |

| X.625% | Minus (-) 0.375% and Plus (+) 0.000% |

| X.750% | Minus (-) 0.000% and Plus (+) 0.375% |

| X.875% | Minus (-) 0.125% and Plus (+) 0.250 % |

| X.000% | Minus (-) 0.250% and Plus (+) 0.125% |

| X.125% | Minus (-) 0.375% and Plus (+) 0.000% |

Further examples substituting four (4) or five (5) for X:

| Sample Note Rate | Note Rate Range (see MPF Government MBS Selling Guide

section 3.2.4 for acceptable increments) |

|---|

| 4.000% | 3.750% to 4.125% |

| 4.125% | 3.750% to 4.125% |

| 4.250% | 4.250% to 4.625% |

| 4.375% | 4.250% to 4.625% |

| 4.500% | 4.250% to 4.625% |

| 4.625% | 4.250% to 4.625% |

| 4.750% | 4.750% to 5.125% |

| 4.875% | 4.750% to 5.125% |

| 5.000% | 4.750% to 5.125% |

| 5.125% | 4.750% to 5.125% |

6.36.3 Extending a Delivery Commitment

A Delivery Commitment may be extended prior to its expiration by contacting the MPF Service Center or via the eMPF website. The extension is in one-day increments up to a maximum of thirty (30) Calendar Days. A Delivery Commitment extension fee will be assessed for each extension. The Delivery Commitment must have delivery capacity available in order to be extended.

6.46.4 Closing a Delivery Commitment

A Delivery Commitment is closed on the applicable expiration date or on the date the Delivery Commitment is filled, whichever occurs first.

A Delivery Commitment is considered filled when Mortgage Loans aggregating the maximum permitted dollar amount have been delivered. The maximum permitted dollar amount is the greater of:

- 101% of the original Delivery Commitment amount; or

- The original Delivery Commitment amount plus $100,000.

Price adjustment fees may apply when the aggregate principal amount of the Mortgage Loans delivered under the Delivery Commitment is greater than the Delivery Commitment amount at expiration.

No Mortgage Loan may be delivered under a Delivery Commitment if it would cause that Delivery Commitment to exceed the maximum permitted dollar amount.

6.56.5 Delivery Commitment Fees

This section describes the fees that may be assessed in relation to a Delivery Commitment.

6.5.16.5.1 Pair-off Fees

For each Delivery Commitment of greater than $2 Million or for each MPF Government MBS Mortgage Delivery Commitment of any amount, the PFI will be assessed a Pair-off Fee at expiration when the aggregate principal amount of the Mortgages delivered under a Delivery Commitment amount is less than ninety-nine percent (99%) of the original Delivery Commitment amount. The Pair-off Fee will be calculated on the difference between the aggregate principal amount of the Mortgages actually purchased by the MPF Provider and ninety-nine percent (99%) percent of the original Delivery Commitment amount.

The Pair-off Fee will be calculated as of the close of business on the expiration date of the Delivery Commitment.

Reduced Delivery Commitments

The PFI may reduce the amount of a Delivery Commitment prior to the expiration of that Delivery Commitment. For all Delivery Commitments which are reduced, a Pair-off Fee will be calculated on one hundred percent (100%) of the reduction amount of the Delivery Commitment.

The reduction amount of the Delivery Commitment is the amount of the existing Delivery Commitment less the amount of the reduced Delivery Commitment. The Pair-off Fee will be calculated at the time of the reduction.

6.5.26.5.2 Price Adjustment Fees

For each MPF Government MBS Mortgage Delivery Commitment of any amount, the PFI will be assessed a Price Adjustment Fee when the aggregate principal amount of the Mortgages delivered under a Delivery Commitment amount is greater than one hundred-five percent (101%) of the Delivery Commitment amount at expiration. The Price Adjustment Fee will be assessed at expiration and calculated on the difference between the aggregate principal amount of the Mortgages actually funded or purchased by the MPF Bank and one hundred-one percent (101%) of the original Delivery Commitment amount at expiration.

The Price Adjustment Fee will be calculated as of the close of business on the date that the aggregate principal amount of the Mortgage Loan purchased exceeds the amount of the Delivery Commitment.

6.5.36.5.3 Calculation of the Pair-off Fee and Price Adjustment Fee

The MPF Provider will calculate the Pair-off Fee and Price Adjustment Fee based on the following:

- The nature and amount of the pair-off;

- The premium or discount corresponding to the Note Rate issued for the Delivery Commitment; and

- The premium or discount in effect at the time of pair-off for Delivery Commitments that have the same product type, Note Rate, and delivery period that most closely approximates the remaining term of the Delivery Commitment being paired off.

Pair-off Fees and Price Adjustment Fees will be charged to the PFI's DDA. Under no circumstances will these fees be paid directly to the PFI.

7Chapter 7: Mortgage Loan Purchase

Last Updated: May 27, 2025

7.17.1 Government Mortgage Loan Seasoning Requirements

In addition to complying with all MPF Program and applicable Government Agency requirements for Government Loans, MPF Government MBS Mortgage Loans must meet the following criteria:

- No more than twelve (12) Principal and Interest Payments have been applied to the Mortgage Loan from the original Note date; and

- The most recent payment due from the Borrower cannot be past due:

- For scheduled/scheduled remittance type, Mortgage Loans must be current through the end of the month prior to delivery to the MPF Bank or MPF Provider.

7.27.2 Data to Be Submitted (05/27/25)

In order to deliver a Mortgage Loan under the MPF Program, the following data must be submitted electronically via the eMPF website:

- PFI number and name

- PFI loan number

- Loan Application Date

- Name of the person submitting data and authorized to deliver Mortgages

- Master Commitment number

- Delivery Commitment number

- Borrower(s) name

- Borrower(s) ethnicity

- Borrower(s) race or national origin

- Borrower(s) gender

- Borrower(s) age

- Borrower(s) date of birth

- Borrower(s) monthly income

- Borrower(s) Social Security Number

- Borrower(s) FICO score

- Borrower(s) FICO score source

- Number of Borrowers

- NextGen FICO® score

- Borrower(s) self-employed

- First time buyer

- Loan Origination Source

- Mortgage Identification Number (if MERS registered)

- Loan plan type

- Loan purpose

- Occupancy

- Loan feature

- Product type

- Loan term (in months)

- Note Rate

- Original loan amount

- Appraised value

- Sales price

- Note Date

- Loan-to-Value (LTV) Ratio

- Subordinated financing

- Total Loan-to-Value (TLTV) Ratio

- Housing expense ratio

- Total debt ratio

- Mortgage insurance coverage level (%)

- Mortgage insurance company code (if required)

- Documentation type

- Asset verification

- Automated Underwriting System (AUS)

- Automated Underwriting System (AUS) certificate number

- Appraisal Type

- Buydown

- Anti-predatory lending (APL) category

- HOEPA status

- Rate/APR spread or Average Prime Offer Rate/APR spread

- Higher Priced Mortgage Loan status

- Property street address and apartment number

- City, state and zip code

- Property county name

- Federal Information Processing Standards (FIPS) code

- Property type

- Manufactured housing information

- Number of bedrooms per unit

- Unit owner occupied per unit

- Rent level per unit

- Rent plus utilities per unit

- Principal and Interest Payment

- Outstanding loan balance

- First payment due date

- Next payment due date

- Maturity date

- Funding Date

- Investor due date

- Disbursement date (if refinance)

- Loan Originator and Originator’s Company ID numbers

- Appraiser state license number (if signor on Appraisal form)

- Agency case number (Government Loan only)

- Current Loan-to-Value ratio (seasoned loan only)

- Pay history (seasoned loan only)

Note: Borrower and Co-Borrower income must be collected and delivered to the MPF Provider for all Government Mortgage Loans, regardless of the applicable Government Agency’s requirement to use or collect such information.

In addition to the above requirements, the PFI must submit an electronic transmission of data via eMPF in the following file formats: Detailed List of Uniform Loan Delivery Data (ULDD) File and the Additional Information File. In addition to submitting the electronic data files listed above the PFI must provide a scanned file to the MPF Service Center via the “Upload Mortgage File Documents” link on eMPF within 7 (seven) days of funding containing copies of the following documents in the below order:

- MPF Government MBS Data Validation Checklist ( Exhibit S-M), which provides the MPF Provider loan number;

- Underwriting Transmittal Summary:

- FHA loans: Form 92900 LT;

- VA loans: Form 1008, VA Loan Analysis (Final and Signed), and IRRRL Worksheet, if applicable; or

- RHS loans: Form 1008.

- Automated Underwriting System (AUS) Certificate or Guaranteed Underwriting System (GUS) Certificate, if applicable;

- Final 1003 Loan Application;

- Case Number Assignment:

- FHA loans: Case Number Assignment– including ADP Code;

- VA loans: Loan note Guarantee (LGC) (IRRRL Case Number Assignment and/or Case Number Assignment if LGC is not available); or

- RHS loans: USDA-RD Form RD 1980-18 Conditional Commitment or Loan Note Guarantee.

- Final Credit Report with any updates;

- Appraisal and any updates or addendums (VA Mortgage Loans must include Notice of Value);

- Note with all applicable riders;

- If the mortgage loan was re-amortized and modified due to the application of a principal curtailments, PFIs must provide the fully executed re-amortization documentation;

- Mortgage with all applicable riders-stamped true and certified copy; and

- Settlement Statement or final Closing Statement-stamped true and certified copy.

7.37.3 Purchase Requirements

In order to qualify for purchase under the MPF Program, the Mortgage Loan must meet the following requirements:

- Be assigned to an open Delivery Commitment that corresponds to the applicable MPF Mortgage Product;

- Not cause the maximum permitted amount of the referenced Delivery Commitment to be exceeded (within tolerance limits); and

- Have the entire principal amount of the Mortgage Loan fully disbursed to the Borrower, or disbursed or advanced in accordance with the direction of the Borrower, prior to the purchase of the Mortgage Loan by the MPF Provider. For example, a refinance Mortgage Loan cannot be delivered under the MPF Program during any applicable rescission period for the refinance Mortgage.

7.47.4 Amount to be Paid

Mortgage Loans will be purchased in the amount of the current principal balance plus interim interest, from the prior payment date to the Funding Date, calculated on a 30/360 basis at the pass-through rate, plus or minus any applicable premium or discount.

For the scheduled/scheduled remittance type, the "outstanding loan balance" on the Loan Presentment Request (Form OG3) is the scheduled principal balance as of the month delivered (if the first payment date is in the future, it is the scheduled principle balance following application of the first payment).

7.4.17.4.1 Payment Method

Upon determination that a Mortgage Loan can be purchased, the MPF Provider will deposit funds in the PFI's DDA. The purchase of a Mortgage Loan will be confirmed with the PFI on the Funding Date via e-mail or electronically.

The first payment due date for all Mortgage Loans should be the first day of the second month following the disbursement date of the Mortgage.

7.4.27.4.2 Reconciliation

If at a later date it is determined that a payment error has taken place, regardless of the source of the error, the MPF Provider will make adjusting debits or credits to the PFI's DDA and confirm the details of such adjustments with the PFI.

7.4.37.4.3 Premium Pricing Reimbursement

The MPF Provider reserves the right to request reimbursement for any premiums paid in connection with Mortgage Loans that are paid off within 120 days of the Funding Date.

7.4.47.4.4 Early Payment Default Breach

If any of the first three (3) monthly payments due after an MPF Government MBS Mortgage Loan is delivered into the MPF Program becomes Delinquent and is not paid on or before the next scheduled due date of the monthly payment, the MPF Provider or the MPF Bank may require the PFI or Servicer to repurchase the related Mortgage Loan within (7) Business Days after receipt of written notice of the Early Payment Default. This repurchase obligation only applies where the Mortgage Loan is delivered into the MPF Program within one year of its origination date.

Related Resources

8Chapter 8: Document Delivery to the MPF Government MBS Custodian

Last Updated: Dec 17, 2025

The Collateral Files for MPF Government MBS Mortgage Loans must be held by the MPF Government MBS Custodian. The PFI must obtain acceptance from the MPF Government MBS Custodian that documents are in proper form and are properly executed. PFIs should reference MPF Custody Frequently Asked Questions and Answers (Exhibit J-M) for assistance with the MPF Custody process.

8.18.1 Collateral File Package

Documents must be submitted to the MPF Government MBS Custodian in the order specified in a legal-sized manila folder. The outside of the manila folder must identify the MPF Program, the PFI's name, the Master Commitment number, the Borrower's name, the MPF loan number and the PFI's loan number.

Collateral Files must be sent in MPF loan number order to the MPF Government MBS Custodian.

The following documents must be sent to the MPF Government MBS Custodian in the order indicated:

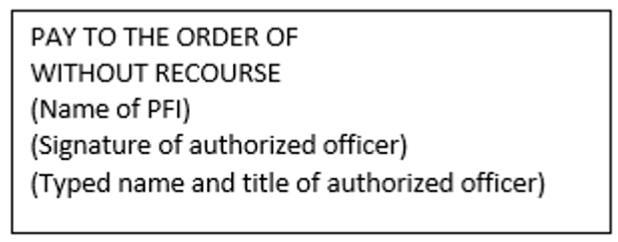

- Original Note with proper endorsements;

- For MPF Government MBS Mortgages, in the case of a lost Note, a replacement Note must be executed by the mortgagor in accordance with the Initial Certification Review Checklist for MPF Government MBS ( Exhibit K-M). A lost note affidavit or a lost instrument bond cannot substitute for the original Note.

- The original unrecorded Assignment of the Security Instrument "in blank" from the PFI;

- Original unrecorded Assignments of the Security Instrument from the Affiliate to the PFI (if applicable);

- All recorded Intervening Assignments or certified copies of Intervening Assignments sent for recording (if applicable);

- Original/certified copy of the Power of Attorney (if applicable);

- Any rider, addendum, modification or Assumption that modifies the Note (if applicable); and

- Trust Agreement(s) (if applicable).

Any copies provided must be certified with the following signed statement: “certified to be a true and correct copy of the original.”

8.1.18.1.1 New York Consolidation, Extension, and Modification Agreements (CEMA) (5/27/25)

For CEMA, the following documents must be submitted to the MPF Government MBS Custodian:

Original/Certified Copy of the most current version of CEMA (FNMA/FHLMC Form 3172);

- FNMA/FHLMC Form 3172 Exhibits "A", "B", "C", and "D". Exhibit "A" must list all Notes and Security Instruments being consolidated, modified and extended;

- The original consolidated Note evidencing the new indebtedness endorsed "in blank", without recourse. (For loans sold under an MFP Government MBS Servicing Released Master Commitment, the PFI must endorse the Note to the Federal Home Loan Bank of Chicago.); and

- Completed Exhibit G-M: MPF Government MBS Custodian Manifest Template.

See the Initial Certification Review Checklist for MPF Government MBS ( Exhibit K-M) for more CEMA requirements.

8.1.28.1.2 Data Accuracy

The PFI is responsible for reviewing all Mortgage documents for completeness and accuracy, and is responsible for the correction of all errors prior to submission to the MPF Government MBS Custodian. All Closing documents must be error-free. If corrections are necessary, strike-overs that are initialed by the Borrower must be used. Corrective coverings are not acceptable.

The names and signatures of each Borrower must be consistent on all Closing documents, and must correspond to the names appearing on the title insurance policy.

8.28.2 Document Safeguarding

The PFI must protect and safeguard all Mortgage documents before they are sent to the MPF Government MBS Custodian or upon release from the MPF Government MBS Custodian. These practices include protection from external elements (such as fire), identification of documents as MPF Provider assets, and separation from other unrelated documents. Collateral Files should be stored in secure, fire resistant facilities with customary controls on access to assure their safety and security.

8.2.18.2.1 Transit Insurance

If the PFI has not contractually agreed with the MPF Government MBS Custodian to have the MPF Government MBS Custodian assume liability for Notes and Assignments and any other documents in the Collateral File while in transit, the PFI must obtain insurance covering physical damage or destruction to, or loss of, any Notes, Assignments and other documents while such documents are in transit between the MPF Government MBS Custodian's premises and anywhere, regardless of the means by which they are transported. For the purpose of this insurance, Mortgage Notes are considered to be "Negotiable Instruments" under Section 3-104 of the Uniform Commercial Code (UCC).

The PFI or PFI’s insurer, insurance broker or agent must notify the MPF Provider at least thirty (30) calendar days prior to cancellation or nonrenewal of the insurance.

The PFI’s insurance policy must:

- Be underwritten by an insurer that has a B+ or better rating and also a financial size category of VI or better according to the A.M. Best Company, or be affiliated with Lloyd's of London;

- Be maintained in an amount that is deemed adequate for the number of Notes and Assignments held in custody and that is deemed appropriate based on prudent business practice; and

- Have a deductible amount no more than the greater of five percent (5%) of the PFI's GAAP net worth or $100,000, but in no case greater than $10,000,000.

If the PFI is covered under its parent's insurance program rather than by its own insurance, then the following additional requirements apply:

- The acceptable deductible amount for each insurance policy may be no more than the greater of five percent (5%) of the parent's GAAP net worth or $100,000, but in no case greater than $10,000,000; and

- The PFI must be a named insured.

8.38.3 Initial Certification Review

The PFI must deliver all required documents to the MPF Government MBS Custodian for review, certification and safekeeping within seven (7) calendar days of the Funding Date by the MPF Provider. The MPF Government MBS Custodian will review the Collateral File in accordance with the Initial Certification Review Checklist for MPF Government MBS ( Exhibit K-M).

For each Collateral File not received and certified within the required time frame, an uncertified loan fee will be assessed to the PFI each calendar day thereafter until the date of Initial Certification by the MPF Government MBS Custodian or repurchase of the Mortgage Loan.

All Collateral Files for MPF Government MBS Mortgages must receive Initial Certification from the MPF Government MBS Custodian within twelve (12) calendar days of the Funding Date. All Mortgages that are not certified within this timeframe are subject to repurchase. Prior to the PFI’s repurchase being initiated, the MPF Provider must effect the repurchase of such MPF Government MBS Mortgage Loan(s) from the Ginnie Mae security in accordance with Ginnie Mae’s requirements.

The MPF Provider will notify the PFI of all Mortgage Loans for which the MPF Government MBS Custodian has not received a Collateral File.

If the MPF Government MBS Custodian determines that the documents submitted are not acceptable, the Collateral File will be suspended or deemed ineligible. The MPF Provider will notify the PFI of any Mortgage Loans for which the Collateral Files are suspended or ineligible, and the detailed reasons for the suspension or ineligibility.

If the MPF Government MBS Custodian sends documents to the PFI for correction, the PFI must immediately correct any defects and return all documents to the MPF Government MBS Custodian. Penalty charges may be assessed for delays in correcting and resubmitting required documents.

8.3.18.3.1 Correction of Exception (5/27/25)

When the PFI discovers an Exception, which includes an error on one of the documents in the Collateral File or a discrepancy between the Loan Presentment information and the loan document information, the PFI must immediately report the Exception by emailing the MPF Custody Department at [email protected] and work with the MPF Custody Department to correct the Exception.

Exceptions are detailed in the Exception Report on the eMPF website. PFIs should reference Exhibit H-M (MPF Government MBS Custodian-Document Codes) and (MPF Government MBS Custodian-Exception Codes) for a translation of the codes on the Exception Report.

8.3.28.3.2 Loan Not Eligible

If the MPF Government MBS Custodian determines that the documents in the Collateral File do not meet the MPF Program requirements, the MPF Government MBS Custodian will inform the MPF Provider of the conditions that cause ineligibility, and the Mortgage Loan must be repurchased by the PFI. The MPF Provider will affect the repurchase by withdrawing the required funds from the PFI's DDA.

8.48.4 Final Certification

The documents for MPF Government MBS Mortgage Loans must be submitted to and certified by the MPF Government MBS Custodian for Final Certification within twelve (12) months of the Funding Date (Conventional Mortgage Loans are not subject to Final Certification). The documents may be forwarded on a piecemeal basis as the PFI receives them, or the documents may be immediately forwarded once the PFI receives all of them. Multiple documents must be delivered in Master Commitment number order and then within each Master Commitment, by MPF loan number order. The final documents may be provided in a legal-sized pocket manila folder, or as an alternative, the PFI may provide the applicable Government Agency insurance certificate or loan guaranty in the acceptable delivery format listed in the Government Mortgage Final Certification Review Checklist ( Exhibit L). The MPF Government MBS Custodian will review the Collateral File in accordance with the Exhibit L.

An uncertified loan fee will be assessed to the PFI each calendar day for each Mortgage Loan that fails to receive Final Certification in the required time frame.

8.4.18.4.1 Required Documentation

The PFI must submit the following documentation for Final Certification:

- The original recorded mortgage or other Security Instrument and, in the case of a modified Government Mortgage, the original Note, the modification agreement, and any required subordination agreement or title endorsement;

- The original (or electronic) Loan Guaranty Certificate (LGC), Mortgage Insurance Certificate (MIC), or Loan Note Guaranty (LNG) evidencing the Mortgage Loan has received insurance or a guaranty from the applicable Government Agency;

If the PFI is unable to obtain the applicable certificate or guarantee, the PFI must submit a fully executed Uninsurable Mortgage Notification for Government Mortgages ( Form SG350M) along with the Request for Release of Documents – MPF Government MBS ( Form SG340M). If the MPF Government MBS Custodian has direct access to FHA Connection or VA TAS, the MPF Government MBS Custodian may reconcile the accuracy of the data directly with the system.

- All original recorded Intervening Assignments or clerk-certified copies; and

- A Mortgagee title insurance policy or other evidence of title acceptable to FHA, VA, RD, or HUD (not required for loans owned by the Secretary of HUD or for VA-Vendee loans if VA does not provide title insurance).

8.4.28.4.2 Past Due Final Certifications

For each Mortgage Loan for which final documents are not received and certified within the required time frame, an uncertified loan fee will be assessed to the PFI each calendar day thereafter until the date of Final Certification by the MPF Government MBS Custodian, pledging collateral or repurchase of the Mortgage Loan.

If an MPF Government MBS Mortgage Loan has not received final certification within twelve (12) months from the Funding Date the PFI may be required to repurchase the Mortgage Loan. Prior to the PFI’s repurchase being initiated, the MPF Provider must effect the repurchase of such MPF Government MBS Mortgage Loan(s) from the Ginnie Mae security in accordance with Ginnie Mae’s requirements.

No more than four percent (4%) of the Mortgage Loans in the PFI’s MPF Government MBS Mortgage Master Commitments may be past due for Final Certification. If the past due ratio exceeds 4%, at the sole discretion of the MPF Provider, the PFI must:

- Pledge collateral equal to one hundred percent (100%) of the aggregate unpaid Principal Balance of the overdue MPF Government MBS Mortgage Loans, as of the date of the MPF Provider notifies the PFI, in accordance with the PFI’s Advances Agreement. The amount due for all MPF Government MBS Mortgage Loans requiring collateralization may be combined into a single collateralization. If the PFI brings its MPF Government MBS Mortgage Loans into compliance with the tolerance levels stated above before the collateralization expires, the PFI may request that the MPF Provider release its collateral. If after the six-month period the Government Loans are still not in compliance with the Final Certification thresholds, the collateralization must be extended prior to expiration; or

- Repurchase the overdue Government Mortgages.

For any Government Mortgage Loans past due for Final Certification after three (3) years, the PFI will be required to collateralize the Principal Balance of the overdue Government Mortgage Loans or repurchase such Mortgage Loans, regardless of the percentages of total Mortgage Loans past due for Final Certification.

8.58.5 MPF Government MBS Custodian Fees and Service Charges

The MPF Government MBS Custodian assesses the PFI the following fees and service charges:

- Rush release or rejected release request: (i) a request issued within the timelines listed below or (ii) for an invalid release request as determined by the MPF Government MBS Custodian.

- 1 Business Day turnaround -- $5.00

- 2 Business Day turnaround -- $3.50

- Nonstandard or rejected release request - A fee charged to the PFI for: (i) the release of a Collateral File for a purpose other than Liquidation, Foreclosure or other Servicing responsibility that requires the physical possession of the Note or other documents (such as Exception correction for Initial or Final Certification requirements, etc.) or (ii) an invalid release request as determined by the MPF Government MBS Custodian.

- 1 Business Day turnaround -- $5.00

- 2 Business Day turnaround -- $3.50

- 3-4 Business Day turnaround -- $2.00

- Non-standard or rejected file reinstatement requests -- A fee charged to the PFI for: (i) the file reinstatement following a release request for a purpose other than Liquidation, Foreclosure or other Servicing responsibility that requires the physical possession of the Note or other documents (such as Exception correction for Initial or Final Certification requirements, etc.) or (ii) an invalid reinstatement request as determined by the MPF Government MBS Custodian -- $3.00

- Copies of documents -- $1.00 plus $0.25 per single sided copy

- Exception correction (per Exception) – A fee charged to the PFI for every Exception cited by the MPF Government MBS Custodian for Initial Certification, Final Certification, or recertification. Exception fees will be billed to a new PFI once one of the following occurs: sixty (60) calendar days have passed from first receipt of Collateral Files or one hundred (100) Collateral Files have been received by the MPF Government MBS Custodian from the PFI -- $3.50

- External file transfer (change of Custodian) -- $3.50

The MPF Provider will create preliminary custody invoices no later than the fifth (5th) Business Day of each month for the custody fees and service charges accrued in the previous month. The MPF Provider will create the final custody invoices on the eighteenth (18th) calendar day of each month or on the preceding Business Day if the eighteenth (18th) is not a Business Day, indicating the amount that will be drafted from the PFI’s DDA. Both the preliminary and final invoices are available on the eMPF website. The MPF Provider reserves the right to amend the custodian fee schedule from time to time.

Related Resources

10Chapter 10: Servicing Requirements

Last Updated: May 27, 2025

This chapter provides an overview for servicing retained loans and servicing released loans.

This chapter does not cover the requirements for the following types of transfers (which are addressed in the Servicing Guide):

- Transfers of servicing initiated post-loan delivery; or

- Transfers of servicing arising from mergers or other portfolio dispositions.

10.110.1 Servicing Retained

PFIs that are retaining the Servicing of the Mortgage Loans must refer to the MPF Government MBS Servicing Guide for the MPF Program servicing requirements.

For FHA Mortgage Loans where the Servicing is retained by the PFI, the PFI must report the change of holder to the FHLBC using FHA Connection within ninety (90) days of the endorsement of the case for FHA insurance. The FHLBC’s FHA Holder ID number is 94089.

10.210.2 Servicing Released (5/27/25)

To participate in this concurrent sale of servicing option, PFIs must contact their MPF Bank Representative.

For FHA Mortgage Loans where the Servicing is retained by the PFI, the PFI must report the change of holder and Servicer using FHA Connection within 90 (ninety) days of the endorsement of the case for FHA insurance. The FHLBC’s FHA Holder ID number is 94089.

Related Resources