9.2.19.2.1 Forbearance Plan

9.2.1.19.2.1.1 Overview

Servicers must consider a forbearance plan when the Borrower is experiencing a temporary hardship that has not been resolved. Servicers are authorized to offer the Borrower a forbearance plan that would reduce or suspend the Borrowers payments in increments, not to exceed a cumulative term of 12 months. Servicers are not required to obtain prior approval from the MPF Bank if all of the requirements outlined in this section are met. Any exceptions to eligibility requirements or to forbearance plan terms must be submitted for MPF Bank approval prior to offering the forbearance plan in accordance to Section “9.1.6 Submission to MPF Banks.” If the Borrower is not eligible for a forbearance plan, Servicers are required to evaluate Borrowers for other options in the order based on the Workout Hierarchy in Section “9.1.24 Workout Hierarchy.”

9.2.1.29.2.1.2 Determining Eligibility for a Forbearance Plan (3/18/25)

Servicers are authorized to evaluate the Borrower for a forbearance plan without receiving a complete Workout Request Package (WRP).

The following eligibility criteria for a forbearance plan must be met at the time of evaluation:

- The Servicer must achieve QRPC with the Borrower, in accordance to Section “8.3.2 Contacting Borrowers.”

- Note: If the Borrower’s hardship is due to a disaster event, the Servicer is authorized to offer an initial 90-day forbearance plan without achieving QRPC and without obtaining MPF Bank approval, in accordance with 8.5.2 Offering Assistance to the Borrower.

- The Borrower must have an eligible hardship.

- Note: While a WRP is not required, see the Workout Request Application ( Form SG355) for types of eligible hardships.

- The property securing the mortgage loan must be a primary residence.

- Note: If the Borrower’s hardship is due to a disaster event, the property securing the mortgage loan may be a second home.

- The property securing the mortgage loan must not be condemned or abandoned.

- Note: The property securing the mortgage loan may not be vacant.

If the Servicer determines the Borrower is not eligible for a forbearance plan but there are acceptable mitigating circumstances, it must request prior written approval from the MPF Bank by submitting the completed Form SG354 and all supporting documentation to the MPF Provider via eMAQCSplus. See Section “9.1.6 Submission to MPF Banks” and Section “9.1.7 Submission for Exceptions.” Generally, the Servicer’s determination of acceptable mitigating circumstances should be based on a review of the Borrower’s complete WRP.

9.2.1.39.2.1.3 Forbearance Plan Terms

If the Borrower meets the eligibility criteria for a Forbearance Plan, the Servicer is authorized to:

- offer an initial forbearance plan term of up to 6 months, and

- grant an extension of the initial forbearance plan term of up to 6 additional months.

Note: Servicers are authorized to offer the 6-month terms in separate, shorter increments.

Servicers must receive prior written approval from the MPF Bank for a forbearance plan to:

- exceed a cumulative term of 12 months as measured from the start date of the initial forbearance plan, or

- result in the mortgage loan becoming greater than 12 months delinquent.

The Borrower’s monthly payment must be reduced or suspended during the forbearance plan term.

When the Servicer requires the Borrower to make reduced payments, the payment must be received on or before the last day of the month in which it is due, unless the Servicer determines that acceptable mitigating circumstances caused the payment to be late.

The forbearance plan terms must be provided to the Borrower in writing. No MPF Program form is required, but the decisions notice used by the Servicer must provide Borrower with, at minimum, the following information:

- Loan number (i.e. borrower facing loan number if different than MPF loan number)

- Any information or notice required by Applicable Law

- Servicer contact information

- If plan reduces payments:

- Total term in number of months

- Break down for each payment of:

- Statement that Borrower can accept the plan by making the first reduced payment amount noted in notice by the due date

- If plan suspends payments:

- Forbearance period beginning payment date (i.e. when it starts)

See Section “9.1.22.4 Sending a Notice of Decision on a Workout Option” for additional information.

Once the forbearance plan is complete, one of the following must occur:

- the mortgage loan must be brought current through a reinstatement,

- the Borrower is approved for another workout option pursuant to the Workout Hierarchy in Section “9.1.24 Workout Hierarchy” of this Guide,

- the mortgage loan is paid in full, or

- the Servicer refers the mortgage loan to foreclosure in accordance with applicable law.

Servicers must terminate the forbearance plan and proceed as if the plan was complete if it determines:

- the Borrower failed to meet any terms specified in the forbearance plan,

- any of the eligibility criteria for the forbearance plan are no longer satisfied,

- the Borrower’s hardship is resolved, or

- the Borrower requests that the forbearance plan be terminated.

9.2.1.49.2.1.4 Contacting the Borrower During a Forbearance Plan Term

Servicers must begin attempts to contact the Borrower no later than 30 days prior to the expiration of any forbearance plan term and must continue outreach attempts until either QRPC is achieved or the forbearance plan term has expired.

Servicers must follow the below requirements depending upon whether QRPC is achieved:

- If QRPC is achieved, Servicer must determine the following:

- if the Borrower’s hardship has been resolved,

- the Borrower’s intention with respect to the property, and

- whether the Borrower needs to submit a complete WRP to be evaluated for other workout options.

For additional information on contacting the Borrower refer to See Section “8.3.2 Contacting Borrowers” for details on QRPC requirements.

9.2.1.59.2.1.5 Handling Late Charges in Connection with a Forbearance Plan

The Servicer must not accrue or collect late charges from the Borrower during the forbearance plan. If the borrower defaults on the terms of the forbearance plan, the Servicer is authorized to accrue late charges from the date the Borrower defaulted on the plan.

9.2.1.69.2.1.6 MPF Reporting

Once the Borrower agrees to the terms of the forbearance plan, the Servicer must report the forbearance plan on the Delinquent Mortgage & Bankruptcy Status Report (Exhibit B) monthly with an Action Code = 20, a Delinquency Status Code = 9, the applicable Delinquency Reason Code, a Loss Mitigation Type = FFA or Formal Forbearance Agreement accompanied by the Loss Mitigation Approval (effective) Date and Loss Mitigation Estimated Completion Date or Loss Mitigation Actual Completion Date, as applicable.

9.2.29.2.2 Repayment Plan

9.2.2.19.2.2.1 Overview

Servicers must consider a repayment plan when the Borrower’s temporary hardship appears to have been resolved and the Borrower is not able to reinstate the mortgage loan. Servicers are authorized to offer the Borrower a repayment plan that would allow Borrower to make payments in excess of the regular monthly payments over a period not to exceed 12 months. Servicers are not required to obtain prior approval from the MPF Bank if all of the requirements outlined in this section are met. Any exceptions to eligibility requirements or to repayment plan terms must be submitted for MPF Bank approval prior to offering the repayment plan in accordance to Section “9.1.7 Submission for Exceptions.” If the Borrower is not eligible for a repayment plan, Servicers are required to evaluate Borrowers for other options in the order based on the Workout Hierarchy in “9.1.24 Workout Hierarchy.”

9.2.2.29.2.2.2 Repayment Plan Terms

Servicers are authorized to evaluate the Borrower for a repayment plan without receiving a complete Workout Request Package (WRP). However, if the Borrower submitted a complete WRP, the Servicer must evaluate the Borrower in accordance with the evaluation requirements as indicated in Section “9.1.23 Determining the Appropriate Workout Option.”

The following requirements apply to repayment plans:

- Servicer must consider a repayment plan when the delinquency resulted from a temporary hardship that no longer appears to be a problem.

- The total monthly repayment plan payment must not exceed 150% of the full monthly contractual payment.

The repayment plan terms must be provided to the Borrower in writing. No MPF Program form is required, but the decisions notice used by the Servicer must provide Borrower with, at minimum, the following information:

- Loan number (i.e. borrower facing loan number if different than MPF loan number)

- Any information or notice required by Applicable Law

- Servicer contact information

- Break down for each payment of:

- Additional Monthly Payment

- Total Monthly Payment Amount

- Statement that Borrower can accept the plan by making the first Total Monthly Payment Amount noted in notice by the due date

See Section “9.1.22.4 Sending a Notice of Decision on a Workout Option” for additional information.

Repayment plans must meet the following requirements:

- If, at the time of evaluation, the mortgage loan is less than or equal to 90 days delinquent and the term of the repayment plan does not exceed six months then:

- The Borrower is not required to submit a complete WRP.

- The Borrower must have the financial capacity to bring the mortgage loan current during the repayment plan; which may be verified through QRPC if the offer is not based on a complete WRP.

- If, at the time of evaluation, the mortgage loan is greater than 90 days delinquent or the term of the repayment plan exceeds six months, the Borrower is required to submit a complete WRP and:

- If the repayment plan exceeds 12 months, Servicer must obtain MPF Bank approval prior to offering the repayment plan by submitting Form SG354 (Note: Form SG354 must be used, no alternative or equivalent forms are permitted) and required supporting documentation in accordance to Section “9.1.7 Submission for Exceptions.” (Note: If repayment plan is less than 12 months, no prior approval is required)

- The Servicer may evaluate the Borrower for other workout options as an alternative to a repayment plan in the order based on the Workout Hierarchy in “9.1.24 Workout Hierarchy.”

9.2.2.39.2.2.3 Handling Late Charges with a Repayment Plan

The repayment plan may include accrued late charges due when the plan is established between the Servicer and the Borrower. The Servicer must waive late charges accrued during the repayment plan period as long as the terms of the repayment plan are maintained by the Borrower.

9.2.2.49.2.2.4 MPF Reporting

Once the Borrower agrees to the terms of the repayment plan, the Servicer must report the repayment plan on the Delinquent Mortgage & Bankruptcy Status Report (Exhibit B) monthly with an Action Code = 20, a Delinquency Status Code = 12, the applicable Delinquency Reason Code, a Loss Mitigation Type = Repayment Plan or REPAYMENT PLAN accompanied by the Loss Mitigation Approval (effective) Date and Loss Mitigation Estimated Completion Date or Loss Mitigation Actual Completion Date, as applicable.

9.2.39.2.3 Payment Deferral

9.2.3.19.2.3.1 Overview

Servicers must consider a payment deferral, for Borrowers that have resolved a temporary hardship and are prepared to resume their monthly contractual payments but cannot afford either a full reinstatement or repayment plan to bring the mortgage loan current. Servicers are authorized to offer the Borrower a deferral, that will defer the past-due P&I payments as a non-interest bearing balance, due and payable at maturity of the mortgage loan, or earlier upon the sale or transfer of the property, refinance of the mortgage loan, or payoff of the interest-bearing UPB. Servicers are not required to obtain prior approval from the MPF Bank if all of the requirements outlined in this section are met, but Servicers are required to submit a completed Workout Worksheet ( Form SG354) (Note: Form SG354 must be used, no alternative or equivalent forms are permitted) via eMAQCSplus in accordance to Section “9.2.3.5 Completing a Payment Deferral.” Any exceptions to eligibility or other payment deferral requirements must be submitted for MPF Bank approval prior to offering the payment deferral in accordance to Section “9.1.7 Submission for Exceptions.” If the Borrower is not eligible for a payment deferral, Servicers must consider the Borrower for a loan modification pursuant to the eligibility criteria and the Workout Hierarchy in Section “9.1.24 Workout Hierarchy.”

9.2.3.29.2.3.2 Determining Eligibility for Payment Deferral (3/18/25)

The Servicer is authorized to evaluate the Borrower for a payment deferral without receiving a complete Workout Request Package (WRP). If the Borrower submitted a complete WRP, then the Servicer must evaluate the Borrower in accordance with Section 9.1.23 Determining the Appropriate Workout Option. Servicers are authorized to use Form SG356: Payment Deferral Agreement, while the use of Form SG356 is optional, it reflects the minimum level of information that the Servicer must provide to the Borrower.

In order to be eligible for a payment deferral, the following criteria must be met:

- The mortgage loan must be a conventional first lien mortgage loan, and remain in first lien position during the Payment Deferral.

- Note: The property securing the mortgage loan may not be vacant or condemned.

- The mortgage loan must meet the following delinquency parameters:

- The mortgage loan must be equal to or greater than 2 months delinquent but less than or equal to 6 months delinquent as of the date of evaluation; or

- The loan is currently in a Forbearance Plan. The Forbearance Plan must not exceed 6 months of past due P&I payments.

Note: For Borrowers 6 months delinquent when being evaluated, Servicers must receive the Borrower’s full monthly contractual payment due for the month of evaluation. If the Servicer has not received this full monthly contractual payment as of the date of evaluation, the Borrower may still be eligible for a payment deferral if they make the full monthly contractual payment by the end of the evaluation month.

- If the Borrower’s hardship is due to a disaster event, the mortgage loan must meet the requirements in 9.1.4 Borrowers Impacted by a Major Disaster and meet the following delinquency parameters:

- the mortgage loan must have been current or less than two months delinquent at the time the disaster occurred (i.e., disaster occurs on March 20, the Borrower has a last paid installment of January 1, when the disaster occurred), and

- be equal to or greater than one month delinquent but less than or equal to 12 months delinquent as of the date of evaluation.

Note: If a borrower’s hardship is related to disaster but they were two or more months delinquent as of the date the disaster occurred, and the servicer determines the borrower can maintain their full monthly contractual payment, then the servicer must

- Servicer must achieve QRPC with the Borrower in accordance with Section “8.3.2 Contacting Borrowers,”

- Servicer must confirm that the Borrower:

- has resolved the hardship,

- is able to continue making the full monthly contractual payment including the amount required to repay any escrow shortage amount over a term of up to 60 months, and

- is unable to reinstate the mortgage loan or afford a repayment plan to cure the delinquency.

- The mortgage loan must meet the following:

- For non-disaster related payment deferrals:

- The mortgage loan must have been originated at least 12 months prior to the evaluation date for a payment deferral.

- The mortgage loan may receive more than one payment deferral; however, no more than 12 months of cumulative past-due P&I payments as a result of a payment deferral may be deferred over the life of the mortgage loan.

- Note: This cumulative cap does not include past-due P&I payments deferred as the result of a COVID-19 payment deferral.

- The mortgage loan must not have received a prior payment deferral with an effective date within 12 months of the evaluation date.

- For disaster related payment deferrals, the mortgage loan must not have previously received a disaster payment deferral as a result of the same disaster event. Note: The mortgage loan may have previously received a non-disaster payment deferral.

- The mortgage loan must not be within 36 months of its maturity or projected payoff date.

- Note: If the Borrower is otherwise eligible for a payment deferral and the Servicer determines that a payment deferral is the appropriate solution based on the borrower’s circumstances, then the Servicer must submit a request for an exception in accordance to Section “9.1.7 Submission for Exceptions.”

- The mortgage loan must not be subject to:

- a recourse or indemnification arrangement under which the MPF Bank purchased the mortgage loan or that was imposed by the MPF Bank after the mortgage loan was purchased,

- an approved liquidation workout option,

- an active and performing repayment plan,

- a current offer for another retention workout option, or

- an active and performing mortgage loan modification Trial Period Plan.

- The Borrower must not have failed a non-disaster related mortgage loan modification Trial Period Plan within 12 months of being evaluated for eligibility for a payment deferral.

- Note: Converting from a Trial Period Plan to a forbearance plan is not considered a failed Trial Period Plan.

- The mortgage loan must not have been modified with a permanent Mortgage Loan Modification within the previous 12 months of being evaluated for eligibility for a payment deferral.

9.2.3.39.2.3.3 Performing an Escrow Analysis for a Payment Deferral

When a Borrower is eligible for a payment deferral and the Servicer was not collecting escrows on the existing mortgage loan, the Servicer is not required to revoke any escrow deposit account waiver and establish an escrow deposit account as a condition of the payment deferral if the Servicer confirms the Borrower is current on the payments for taxes, special assessments, property and flood insurance payments, payments for borrower-purchased MI, ground rents, and similar items.

Prior to offering a payment deferral, the Servicer must analyze an existing escrow account to estimate the periodic escrow deposit required to ensure adequate funds are available to pay future charges, taking into consideration T&I payments that may come due during the processing month, if applicable.

If the Servicer identifies an escrow shortage as the result of an escrow analysis in connection with a payment deferral, the Servicer must spread repayment of the escrow shortage amount in equal monthly payments over a term of 60 months, unless the Borrower decides to pay the shortage amount up-front or over a shorter period, not less than 12 months. Any subsequent escrow shortage that may be identified in the next annual analysis cycle must be spread out over either the remaining term of the initial escrow shortage repayment period or another period of up to 60 months.

Any escrow account shortage that is identified at the time of the payment deferral must not be included in the non- interest bearing balance and the Servicer is not required to fund any existing escrow account shortage.

If applicable law prohibits the establishment of the escrow account, the servicer must ensure that the T&I payments are paid to date.

9.2.3.49.2.3.4 Payment Deferral Terms (3/18/25)

The Servicer must defer the following amounts as a non-interest bearing balance, due and payable at maturity of the mortgage loan, or earlier upon the sale or transfer of the property, refinance of the mortgage loan, or payoff of the interest-bearing UPB:

- P&I:

- for non-disaster related payment deferrals, the Servicer must defer at least 2 months and up to 6 months of past-due P&I payments, provided that it does not result in more than 12 months of past-due P&I payments cumulatively deferred as a result of a payment deferral; or

- for disaster related payment deferrals, up to 12 months of past-due P&I payments;

- out-of-pocket escrow advances resulting from a delinquency and paid to third parties, provided they are paid prior to the effective date of the payment deferral; and

- servicing advances resulting from a delinquency, paid to third parties in the ordinary course of business, and not retained by the servicer, provided they are paid prior to the effective date of the payment deferral, if allowed by state law.

All other terms of the mortgage loan must remain unchanged. The Servicer represents and warrants that application of the payment deferral to the mortgage loan does not impair our first lien position or enforceability against the borrower(s) in accordance with its terms.

Any existing non-interest bearing balance on the mortgage loan remains due and payable at maturity of the mortgage loan, or earlier upon the sale or transfer of the property, refinance of the mortgage loan, or payoff of the interest-bearing UPB.

Servicer is required to ensure that the loan is not out of balance with the Investor on their TAR (Turn Around Report) and that their Monthly Summary and Remittance Report (SG300) reflects the correct the loan level data (including UPB) Servicer is relying on to determine eligibility. Loan Level discrepancies require resolution prior to completing a Payment Deferral. See Section “2.13.1 Monthly Accounting Reports.”

9.2.3.59.2.3.5 Completing a Payment Deferral

Servicers must complete a payment deferral in the same month in which it determines the Borrower is eligible by submitting a completed Workout Worksheet ( Form SG354) (Note: Form SG354 must be used, no alternative or equivalent forms are permitted) via eMAQCSplus, with all required supporting documentation as indicated on the Workout Worksheet.

If the Servicer is unable to complete the payment deferral prior to the 15th day of the evaluation month, then the Servicer is authorized to allow for sufficient processing time (via a “processing month”) to complete a payment deferral. The Servicer must treat all borrowers equally in applying the processing month, as evidenced by a written policy.

Servicers are authorized to use an additional month to allow for sufficient processing time (“processing month”) to complete a payment deferral Borrowers must make their full monthly contractual payment during the processing month, if as of the date of evaluation:

- the mortgage loan is 6 months delinquent, or

- the payment deferral would cause the mortgage loan to exceed 12 months of cumulative deferred past-due P&I payments over the life of the mortgage loan.

In this circumstance, the Servicer must complete the payment deferral within the processing month after receipt of the Borrower’s full monthly contractual payment due during that month.

Note: Servicers must treat all Borrowers equally in applying the processing month, as evidenced by a written policy.

Servicers must send the Form SG356 Payment Deferral Agreement, or equivalent to the Borrower no later than five days after the completion of the payment deferral. While use of Form SG356 Payment Deferral Agreement is not required, it reflects the minimum level of information that the Servicer must provide to the Borrower.

If the Servicer determines the Borrower’s signature is required on Form SG356 Payment Deferral Agreement, it must receive the executed agreement prior to completing the payment deferral.

The Servicer’s application of a payment deferral to the mortgage loan must not impair our first lien position or enforceability against the Borrower(s) in accordance with its terms.

Servicers must record Form SG356 Payment Deferral Agreement or its equivalent, if the Servicer determines that recordation is required to comply with law and ensure that the mortgage loan retains its first lien position. The Servicer must obtain a title endorsement or similar title insurance product issues by a title insurance company if the Form SG356 Payment Deferral Agreement will be recorded.

Servicers must also provide documents to the document custodian in accordance with the following:

| If the payment deferral agreement is.. | Then the Servicer must send... |

|---|

| not required to be signed by the Borrower | a copy of the Form SG356 Payment Deferral Agreement signed by the Servicer to the document Custodian within 25 days of the effective date of the payment deferral. |

| required to be signed by the Borrower but not recorded | the fully executed original Form SG356 Payment Deferral Agreement to the document Custodian within 25 days of the effective date of the payment deferral. |

| required to be recorded | - a certified copy of the fully executed Form SG356 Payment Deferral Agreement to the document Custodian within 25 days of the effective date of the payment deferral, and

- the original payment deferral agreement that is returned from the recorder’s office to the document custodian within 5 business days of receipt.

|

9.2.3.69.2.3.6 Requirement to Make a Payment During a Processing Month for a Payment Deferral (3/18/25)

The Borrower must make their fully monthly contractual payment during a processing month if, as of the date of evaluation,

- the mortgage loan is

- 6 months delinquent for non-disaster related payment deferrals, or

- 12 months delinquent for disaster related payment deferrals, or

- the payment deferral would cause the mortgage loan to exceed 12 months of cumulative deferred past-due P&I payments.

In this circumstance, the servicer must complete the payment deferral within the processing month as applicable after receipt of the borrower’s full monthly contractual payment due during that month.

9.2.3.79.2.3.7 Handling Fees and Late Charges in Connection with a Payment Deferral

Servicers must not charge the Borrower administrative fees. The Servicer must waive all late charges, penalties, stop payment fees, or similar charges upon completing a payment deferral.

Servicers must follow the procedures in Section “9.2.3.9 Paying Expenses and Requesting Reimbursement Related to a Payment Deferral.”

9.2.3.89.2.3.8 Servicing Fees for a Payment Deferral

The Servicer will continue to receive the servicing fee it was receiving prior to the payment deferral becoming effective. Servicing Fees will be reimbursed for mortgage loans that receive a payment deferral at the time the mortgage loan upon liquidation of the mortgage loan, in accordance to MPF Traditional Servicing guide Section “3.1 Servicing Fees.”

9.2.3.99.2.3.9 Paying Expenses and Requesting Reimbursement Related to a Payment Deferral

The Servicer must pay any necessary and actual out-of-pocket expenses in accordance with the Servicing Guide associated with the execution of a payment deferral, including, but not limited to the following, as applicable:

- any other allowable and documented expense.

Note: The above expenses must not be included in the non-interest bearing balance created by the payment deferral.

Servicing Fees will be reimbursed for mortgage loans that receive a payment deferral upon liquidation of the mortgage loan, in accordance to MPF Traditional Servicing guide Section “3.1 Servicing Fees.”

9.2.3.109.2.3.10 MPF Reporting

Once the Borrower agrees to the terms of the payment deferral, and the Payment Deferral becomes effective, the mortgage loan no longer needs to be reported on the Servicer's Monthly Delinquent Mortgage & Bankruptcy Status Report (

Exhibit B). In addition, Servicers must submit a complete

Form SG354 (

Note: Form SG354 must be used, no alternative or equivalent forms are permitted) via

eMAQCSplus upon the plan becoming effective.

9.2.49.2.4 Loan Modification

9.2.4.19.2.4.1 Overview

Servicers of MPF Traditional loans owned by FHLB San Francisco must only offer temporary loan modifications that meet the requirements detailed in Exhibit FF and permanent loan modifications will only be considered on an exception basis after all other loss mitigation options have been considered (See “9.1.7. Submission for Exceptions.”) All other Servicers may only offer the permanent loan modifications as provided for in this section and may NOT offer temporary loan modifications. See “9.2.4.2 Temporary Loan Modifications.”

Servicers must consider a permanent Loan Modification when the Borrower is experiencing a permanent or long-term decrease in income or increase in expenses, who can resume a monthly payment but cannot afford their monthly contractual payments. Servicers are not required to obtain prior approval from the MPF Bank if all of the requirements outlined in this section are met but may need to submit the Loan Modification Agreement (Form 3179) for execution by MPF Bank (depending upon the entity that is the mortgagee of record) to finalize the agreement. (Note: Form 3179 is a required Form, only changes permitted by Fannie Mae or Freddie Mac are permitted) See Section “9.2.4.12 Executing and Recording the Loan Modification Agreement.” Any exceptions to eligibility or other loan modification requirements must be submitted for MPF Bank approval prior to offering the loan modification in accordance to Section “9.1.7 Submission for Exceptions.” If the Borrower is not eligible for a loan modification, Servicers are required to evaluate Borrowers for other options in the order based on the Workout Hierarchy in Section “9.1.24 Workout Hierarchy.” Servicers are required to submit a completed Workout Worksheet ( Form SG354) (Note: Form SG354 must be used, no alternative or equivalent forms are permitted) via eMAQCSplus in accordance to Section “9.2.4.8 Offering a Trial Period Plan and Completing a Loan Modification.”

9.2.4.29.2.4.2 Temporary Loan Modifications

Borrowers in temporary loan modification plans granted prior to March 1, 2024, nearing the end of their plan, must be notified in writing of the plan termination date and the consequences of such termination, including Borrower’s obligation to resume making their original contractual payments. Servicers must evaluate any Borrowers who claims to be unable to resume making such payments, for workout options based on a complete WRP and based on the Workout Hierarchy in Section “9.1.24 Workout Hierarchy.”

Any such Borrower found to have experienced a permanent or long-term decrease in income or increase in expenses, who cannot afford their original monthly contractual payments should be considered for a permanent loan modification. No temporary loan modifications may be granted or extensions of existing temporary loan modifications may be granted on or after March 1, 2024.

9.2.4.39.2.4.3 Documentation Requirements

If the mortgage loan is current or less than 90 days delinquent, the borrower must submit a complete WRP except as described below.

If the borrower submitted a complete WRP prior to the 90th day of delinquency, the servicer must

- use the information from the WRA, or equivalent, to determine the borrower's hardship, total income and assets, and

- evaluate the borrower for all workout options in accordance with Section “9.1.24 Workout Hierarchy.”

9.2.4.49.2.4.4 Determining Eligibility for a Loan Modification

In order to be eligible for a Loan Modification, the following criteria must all be met:

- The mortgage loan must be a conventional first lien mortgage loan and will remain in first lien position during the Loan Modification plan.

- Note: The property securing the mortgage loan may not be vacant or condemned.

- The mortgage loan must be at least 60 days delinquent or the servicer has determined that the borrower's monthly payment is in imminent default in accordance with Section “9.2.4.4.1 Evaluating a Borrower for Imminent Default for Mortgage Loan Modification Eligibility.”

- The mortgage loan must have been originated at least 12 months prior to the evaluation date for the mortgage loan modification and must not be considered an Early Payment Default loan according to Section “8.6 Early Payment Default.”

- The mortgage loan must not be subject to:

- a recourse or indemnification arrangement under which the MPF Bank purchased the mortgage loan or that was imposed by the MPF Bank after the mortgage loan was purchased;

- an approved liquidation workout option;

- an active and performing repayment plan;

- a current offer for another mortgage loan modification or other workout option; or

- an active and performing mortgage loan modification Trial Period Plan.

- The mortgage loan must not have been permanently modified previously, regardless of the mortgage loan modification program or dates of prior mortgage loan modifications.

- Note: A payment deferral does not count as a mortgage loan modification when determining the number of times the mortgage loan has previously been modified for purposes of determining eligibility for a Loan Modification.

- The borrower must not have failed a Loan Modification Trial Period Plan within 12 months of being evaluated for eligibility for another Loan Modification.

- Note: Converting from a Trial Period Plan to a forbearance plan is not considered a failed Trial Period Plan.

- The mortgage loan must not have received a Temporary Loan Modification and become 60 days or more delinquent within the first 12 months of the effective date of the temporary mortgage loan modification without being reinstated.

- The mortgage loan must not be serviced under one of the following:

- One Mortgage Partners, LLC Mortgage Pass-Through Certificates MPF Shared Funding™ Program Series 2003-1 Trust; or

- One Mortgage Partners, LLC Mortgage Pass-Through Certificates MPF Shared Funding Program Series 2003-2 Trust.

If the borrower converts from a Trial Period Plan to a forbearance plan, the borrower may subsequently be eligible for a Loan Modification upon successful completion of the forbearance plan and, if eligible, must be placed in a new Loan Modification Trial Period Plan based on the delinquency status at the time of the evaluation for the Loan Modification.

9.2.4.4.19.2.4.4.1 Evaluating a Borrower for Imminent Default for Mortgage Loan Modification Eligibility

For a Borrower’s monthly payment to be considered in imminent default for the purpose of determining eligibility for a conventional mortgage loan modification, the borrower must satisfy:

- the initial eligibility criteria, and

- either:

- the credit eligibility criteria; or

- the hardship eligibility criteria.

The Servicer must confirm the following eligibility criteria:

- The mortgage loan is current or less than 60 days delinquent as of the evaluation date.

- The property securing the mortgage loan is occupied as a primary residence by at least one borrower.

- The borrower submits a complete WRP (see Section “9.1.22 Borrower Workout Request Package (WRP) for additional information).

- The borrower’s non-retirement cash reserves are less than $25,000 based on information provided in the WRA, or equivalent.

- The borrower has a hardship as documented in accordance with WRA or equivalent.

Servicer must also determine whether either the following credit or hardship eligibility criteria is satisfied:

| Credit | A FICO credit score less than or equal to 620, and either two or more 30-day delinquencies on the mortgage loan in the six months immediately preceding the month of the evaluation, or Note: The servicer must not consider a missed contractual payment that becomes 60 or more days delinquent as having two or more 30-day delinquencies in the six-month period immediately preceding the month of the evaluation. A pre-modification housing expense-to-income ratio greater than 40% calculated in accordance with the procedures in Section “9.2.4.4.1.1 Calculating the Housing Expense-to-Income Ratio for Imminent Default for a Loan Modification.” Note: The FICO credit score must be no more than 90 days old as of the date of evaluation. If the servicer obtains multiple credit scores for a single borrower, it must select a representative credit score using the lower of two or the middle of three credit scores. If there are multiple borrowers, the servicer must determine the representative score for each borrower and use the lowest representative score as the credit score for the evaluation.

|

|---|

| Hardship | The borrower has one of the following hardships as documented in accordance with WRA or equivalent: - death of a borrower or death of either the primary or secondary wage earner in the household;

- long-term or permanent disability, or serious illness of a borrower, co-borrower, or dependent family member;

- divorce or legal separation;

- separation of borrowers unrelated by marriage, civil union, or similar domestic partnership under applicable law; or

- an increased monthly P&I payment occurred as result of an interest rate adjustment within the last 12 months for a mortgage loan previously modified with a step-rate feature.

|

|---|

If a Borrower whose mortgage loan is current (i.e., not delinquent or in default) is declined a loan modification, the Servicer is responsible for providing Borrower with an Adverse Action Notice compliant with Applicable Laws within 30 days the decision, unless the servicer offers the borrower another retention workout option and the borrower accepts the counteroffer within the 30-day period.

When requesting the MPF Banks’ approval of a recommendation for a loan modification for a borrower facing imminent default, the servicer must either include the draft adverse action notice in its submission, or, if the Servicer has a system that automatically sends such notices, the text of such notice and a statement certifying that it has a process to send notices in accordance with the requirements of this Guide.

9.2.4.4.1.19.2.4.4.1.1 Calculating the Housing Expense-to-Income Ratio for Imminent Default for a Mortgage Loan Modification

The borrower’s monthly gross income is defined as the borrower’s monthly income amount before any payroll deductions and includes the following items, as applicable:

- other compensation for personal services;

- Social Security payments (including Social Security received by adults on behalf of minors or by minors intended for their own support); and

- monthly income from annuities, insurance policies, retirement funds, pensions, disability or death benefits, rental income, and other income such as adoption assistance.

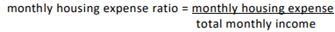

Note: The servicer generally should not consider temporary sources of income related to employment (such as severance payments) as part of the monthly gross income for mortgage loans being evaluated for a workout option. However, public assistance income (such as unemployment) may be considered if done in compliance with applicable laws, and if the servicer determines the probable continuance of such income. The servicer must then divide the borrower’s pre-modification monthly housing expense on the property securing the mortgage loan, which includes the following items (as applicable), by the borrower’s monthly gross income

:

- P&I for all mortgage liens on the property;

- property and flood insurance premiums;

- HOA dues (including utility charges that are attributable to the common areas, but excluding any utility charges that apply to the individual unit); and

- any escrow shortage currently included as part of the full monthly contractual payment.

Note: The servicer must exclude monthly mortgage insurance premiums from the monthly housing expense-to-income calculation.

9.2.4.4.29.2.4.4.2 Evaluating a Borrower with a Disaster-Related Hardship for a Loan Modification (3/18/25)

When evaluating a Borrower with a disaster-related hardship for a loan modification, the following reduced eligibility criteria must be met:

- The mortgage loan must be a first-lien conventional mortgage loan,

- The mortgage loan must:

- Have been current or less than two months delinquent when the disaster occurred, and

- Be at least three months delinquent.

- The mortgage loan must not be subject to

- a recourse or indemnification arrangement under which the MPF Bank purchased the mortgage loan or that was imposed by MPF Bank after the mortgage loan was purchased,

- an approved liquidation workout option,

- an active and performing repayment plan,

- a current offer for another workout option, or

- an active and performing mortgage loan modification Trial Period Plan.

9.2.4.59.2.4.5 Performing an Escrow Analysis

Servicer must perform an escrow analysis prior to offering a Trial Period Plan. See Section “9.2.4.7 Administering an Escrow Account in Connection with a Mortgage Loan Modification.”

Any escrow account shortage that is identified at the time of the mortgage loan modification must not be capitalized and the servicer is not required to fund any existing escrow account shortage.

When Servicer was not collecting escrows on the existing mortgage loan, the Servicer is required to establish an escrow deposit account as a condition of the mortgage loan modification unless otherwise prohibited by applicable law. If applicable law prohibits the establishment of the escrow account, the servicer must ensure that the T&I payments are paid to date.

9.2.4.69.2.4.6 Loan Modification Term

9.2.4.6.19.2.4.6.1 Obtaining a Property Valuation

The servicer must obtain a property valuation, which must not be more than 90 days old at the time the servicer evaluates the borrower for the mortgage loan modification, using one of the following:

- the servicer’s own internal AVM, provided that

- the servicer is subject to supervision by a federal regulatory agency, and

- the servicer’s primary federal regulatory agency has reviewed the model.

If the third-party AVM, or the Servicer’s internal AVM does not render a reliable confidence score, the servicer must obtain an assessment of the property value utilizing an exterior BPO, an appraisal, or a property valuation method documented as acceptable to the Servicer’s federal regulatory supervisor. The property value assessment must be rendered in accordance with the FDIC's Interagency Appraisal and Evaluation Guidelines regardless of whether such guidelines apply to mortgage loan modifications.

The servicer must attach the valuation and documentation when submitting a recommendation for exception to MPF Bank. See Section “9.1.7 Submission for Exceptions.”

9.2.4.6.29.2.4.6.2 Determining New Modified Mortgage Loan Terms (7/17/25)

To determine the borrower's new modified mortgage loan terms, the Servicer must determine the post-modification mark-to-market loan-to-value (“MTMLTV”) ratio, which is defined as the gross UPB of the mortgage loan including capitalized arrearages, divided by the current value of the property.

If the Borrower has made a principal curtailment, the Servicer must first calculate the remaining mortgage loan term based on the interest-bearing portion of the Borrower’s pre-modification UPB and the contractual P&I payment amount prior to proceeding with the steps outlined in the table below.

The servicer must complete all the steps in the order shown in the following table, unless prohibited by applicable law, to determine the borrower's new modified mortgage loan terms, until the earlier of:

- achieving a 20% P&I payment reduction target (i.e. applying the increment or amount as described in each step of the following table to result in a payment reduction that exceeds but is as close as possible to 20% (e.g., 20.01%)); or

- exhausting the steps for determining the modification terms.

| Step | Servicer Action |

|---|

| 1 | Capitalize eligible arrearages. The following are considered as acceptable arrearages for capitalization:

- accrued interest;

- out-of-pocket escrow advances to third parties, provided they are paid prior to the effective date of the mortgage loan modification;

- servicing advances paid to third parties in the ordinary course of business and not retained by the servicer, provided they are paid prior to the effective date of the mortgage loan modification, if allowed by state laws; and

- any outstanding non-interest bearing balance from a previously completed loan modification or a previously completed payment deferral.

Note: If applicable state law prohibits capitalization of past due interest or any other amount, the servicer must collect such funds from the borrower over a period not to exceed 60 months unless the borrower decides to pay the amount up-front. Late charges may not be capitalized and must be waived if the borrower satisfies all conditions of the Trial Period Plan.

See Section “9.2.4.7 Administering an Escrow Account in Connection with a Mortgage Loan Modification” for additional information. |

| 2 | Set the modification interest rate to the contractual interest rate in effect for the periodic payment due in the month of the evaluation date.

Note: The interest rate used to determine the final modification terms must be the same fixed interest rate that was used when determining eligibility for the Trial Period Plan and calculating the Trial Period Plan payment. |

| 3 | If the mortgage loan has a post-modification MTMLTV greater than or equal to 50% and the modified interest rate is greater than the MPF Traditional Loan Modification Interest Rate (See Exhibit EE), then the Servicer must reduce the rate in 0.125% increments until the earlier of: - achieving the 20% P&I payment reduction target, or

- reaching the MPF Traditional Loan Modification Interest Rate ( Exhibit EE)

Note: The MPF Traditional Loan Modification Interest Rate (Exhibit EE) is the minimum rate that may be set for a loan modification. Where the 20% P&I payment reduction target has not yet been achieved but applying a full 0.125% increment would set the modified interest rate to a rate below the MPF Traditional Loan Modification Interest Rate ( Exhibit EE), the Servicer must apply a partial rate reduction increment (i.e., an amount less than 0.125%) to reach the MPF Traditional Loan Modification Interest Rate ( Exhibit EE). |

| 4 | Extend the term in monthly increments until the earlier of:

- achieving the 20% P&I payment reduction target, or

- reaching a term that is 480 months from the mortgage loan modification effective date.

Notes:

- Any loan modification extending the maturity date by more than 20 years from original maturity date, requires MPF Bank approval prior to offering to Borrower.

- When the mortgage loan is secured by a property where the title is held as a leasehold estate, the term of the leasehold estate must not expire prior to the date that is five years beyond the new maturity date of the modified mortgage loan. In the event that the current term of the leasehold estate would expire prior to such date, the term of the leasehold estate must be renegotiated to satisfy this requirement for the mortgage loan to be eligible for the mortgage loan modification.

|

| 5 | Forbear principal if the post-modification MTMLTV ratio is greater than 50%, in an amount that is the lesser of

- an amount that would achieve the 20% P&I payment reduction target,

- an amount that would create a post-modification MTMLTV ratio of 50% using the interest-bearing UPB, or

- 30% of the gross post-modification UPB of the mortgage loan.

Note: Interest must not accrue on any principal forbearance. Principal forbearance is payable upon the earliest of the maturity of the mortgage loan modification, sale or transfer of the property, refinance of the mortgage loan, or payoff of the interest-bearing UPB. |

Servicers are strongly encouraged to use Form SG357 Permanent Loan Modification Worksheet, or its equivalent, to determine the loan modification terms, as Servicers are required to submit that worksheet with Form SG354.

The servicer must request MPF Bank’s prior written approval by submitting a request through eMAQCSplus to deviate from the prescribed steps for determining the new modified mortgage payment terms, unless a certain step is prohibited by applicable state law.

If the steps are exhausted without achieving the 20% P&I payment reduction target, then the Servicer must offer the resulting terms to the Borrower provided the Loan Modification must result in a fixed rate mortgage loan with a monthly P&I payment that is:

- less than the borrower's pre-modification P&I payment, if, at the time of evaluation, the mortgage loan is current or less than 31 days delinquent, or

- less than or equal to the pre-modification P&I payment, if, at the time of evaluation, the mortgage loan is 31 or more days delinquent.

Prior to granting a permanent mortgage loan modification, the Servicer must place the borrower in a Trial Period Plan using the new modified mortgage loan terms. See 9.2.4.8 Offering a Trial Period Plan and Completing a Loan Modification.

Servicers are required to ensure that the loan is not falling out on their TAR (Turn Around Report) and that their Monthly Summary and Remittance Report (SG300) reflects the correct loan level data (including UPB) Servicer is relying on to determine eligibility. Loan Level discrepancies require resolution prior to completing a Loan Modification. See Section “2.13.1 Monthly Accounting Reports.”

Servicers are strongly encouraged to use the Loan Modification Worksheet (see attachment to Form SG354) when determining the modified terms, to ensure the proper amounts are being considered, as that worksheet will be required to be submitted with the Form SG354 once the loan modification is finalized.

9.2.4.79.2.4.7 Administering an Escrow Account in Connection With a Mortgage Loan Modification

When evaluating a borrower for a mortgage loan modification, the Servicer must:

- Revoke any escrow deposit account waiver and establish an escrow deposit account prior to the beginning of the trial payment period in accordance with MPF Program requirements

- If applicable law prohibits the establishment of the escrow account, the Servicer must ensure that the T&I premiums are paid to date.

- Analyze any existing escrow account to estimate the periodic escrow deposit required to ensure adequate funds are available to pay future charges, taking into consideration T&I payments that may come due during any Trial Period Plan. In the event the initial escrow analysis identifies an escrow shortage, the servicer must spread any escrow shortage repayment amount in equal monthly payments over a period of 60 months, unless the borrower decides to pay the escrow shortage amount in a lump sum up-front or over a shorter period, not less than 12 months. Any subsequent escrow shortage that may be identified in the next annual analysis cycle must be spread out over either the remaining term of the initial escrow shortage repayment period or another period of up to 60 months.

- Ensure the borrower’s monthly mortgage loan payments, including trial period payments, include an escrow payment.

9.2.4.89.2.4.8 Offering a Trial Period Plan and Completing a Loan Modification

The Servicer must communicate with the borrower that the mortgage loan modification will not be binding, enforceable, or effective unless all conditions of the mortgage loan modification have been satisfied, which is when all of the following have occurred:

- the borrower has satisfied all of the requirements of the Trial Period Plan,

- the borrower has executed and returned a copy of the Loan Modification Agreement (Fannie Mae Form 3179) (Note: Form 3179 is a required form, only changes permitted by Fannie Mae or Freddie Mac are permitted), and

- the Servicer or MPF Bank (depending upon the entity that is the mortgagee of record) executes and dates Form 3179.

The servicer must use the Form SG358 Permanent Loan Modification Trial Period Plan Notice, or an equivalent form, to document the borrower's Trial Period Plan and comply with the requirements in Section “9.1.22.4 Sending a Notice of Decision on a Workout Option,” and the following:

- if the decision notice is sent on or before the 15th day of a calendar month, the first day of the following month must be the first Trial Period Plan payment due date; or

- if the decision notice is sent after the 15th day of a calendar month, the first day of the after the next month must be the first Trial Period Plan payment due date.

If the Borrower and loan modification meets all eligibility requirements of the Loan Modification Plan, the Servicer does not need to obtain approval prior to providing Borrower a Trial Period Plan Notice. Any exceptions to eligibility or other Loan Modification Plan requirements must be submitted to MPF Provider for approval prior to communicating the terms of the loan modification Trial Period Plan to Borrower.

The length of the Trial Period Plan, which must not change even if the borrower makes scheduled payments earlier than required, must be:

- Four months long if at the time of evaluation the mortgage loan is current or less than 31 days delinquent, or

- Three months long if at the time of evaluation the mortgage loan is 31 or more days delinquent.

If the Borrower fails to make a Trial Period Plan payment by the last day of the month in which it is due, the Borrower is considered to have failed the Trial Period Plan and the servicer must not grant the borrower a permanent Loan Modification.

Near the end of the Trial Plan, the Servicer must use Form SG359 Permanent Loan Modification Cover Letter, or an equivalent form, to communicate a borrower's eligibility for a permanent Loan Modification, which must be accompanied by a completed Form 3179 (Note: Form 3179 is a required Form, only changes permitted by Fannie Mae or Freddie Mac are permitted). See Section “9.2.4.11 Preparing the Loan Modification Agreement."

The Servicer must ensure that the modified mortgage loan retains its first lien position and is fully enforceable in accordance with its terms.

Electronic signatures are not permitted on any document modifying or supplementing the Note or Security Instrument. Any other document permitted to be electronically signed, must comply with Electronic documents, signatures, and notarizations for Loan Modifications are acceptable as long as the electronic record complies with the MPF Program requirements including MPF Program Guide Section 7.4 Electronic Signatures in Global and National Commerce Act (E-Sign).

The Servicer must follow the procedures in Section “9.2.4.12 Executing and Recording the Loan Modification Agreement” and Section “9.2.4.14.1 Adjusting the Mortgage Loan Account Post-Mortgage Loan Modification” for preparing, executing, recording Form 3179 and Section “9.2.4.14_MPF Reporting” for adjusting the mortgage loan account upon completion of the mortgage loan modification.

Servicers do not need to obtain prior approval from the MPF Provider, and do not need to provide the MPF Provider or MPF Bank with any documentation other than submitting a completed Workout Worksheet ( Form SG354) (Note: Form SG354 must be used, no alternative or equivalent forms are permitted) via eMAQCSplus, with all required supporting documentation as indicated on the Workout Worksheet.

9.2.4.99.2.4.9 Resolving an Appeal of a Mortgage Loan Modification Trial Period Plan Denial for a Primary Residence

The servicer must comply with all Applicable Laws as to receiving, assessing and providing Borrower with its decision to a Borrower’s appeal when a loan modification has been denied on a primary residence.

In order for the borrower to be eligible for an appeal of a denial of a mortgage loan modification Trial Period Plan, the following conditions must be met:

- the mortgage loan must be secured by a primary residence, and

- the borrower must have submitted a complete WRP 90 days or more before a scheduled foreclosure sale date, or the foreclosure sale date is unknown.

If, after review of an appeal, the servicer determines that the Borrower was eligible for a mortgage loan modification Trial Period Plan for which the borrower was previously denied, the Servicer must:

- Send the borrower an offer for such a Trial Period Plan for which the borrower was initially denied.

- Provide the borrower 14 days from the date of the servicer’s appeal decision notice to indicate their intent to accept either the new offer or the initial offer, provided that the borrower continues to be eligible for the initial offer, in accordance with Section “9.1.22.4 Sending a Notice of Decision on a Workout Option.”

The servicer’s appeal decision is final and not subject to further appeal. The servicer must make information related to the appeals process available to MPF Provider and MPF Bank upon request.

9.2.4.109.2.4.10 Handling Fees and Late Charges in Connection with a Loan Modification (4/29/25)

The Servicer must not charge the borrower administrative fees. No referral fees, as defined by RESPA, are allowed in connection with Modification Plans.

The Servicer is authorized to assess late charges during the Trial Period Plan, but all late charges, penalties, stop payment fees, or similar charges must be waived when the Trial Plan converts to a permanent mortgage loan modification.

Once the Loan Modification is processed and updated, any recoverable advances will be processed through the applicable remittance account during the monthly remittance process.

9.2.4.119.2.4.11 Preparing the Loan Modification Agreement

The servicer must prepare the Loan Modification Agreement (Form 3179) (Note: Form 3179 is a required Form, only changes permitted by Fannie Mae or Freddie Mac are permitted) early enough in the Trial Period Plan to allow sufficient processing time so that the mortgage loan modification becomes effective on the first day of the month following the Trial Period Plan (modification effective date). The servicer is authorized to, at its discretion, complete the Loan Modification Agreement so the mortgage loan modification becomes effective on the first day of the second month following the final Trial Period Plan payment to allow for sufficient processing time. However, the servicer must treat all borrowers the same in applying this option by selecting, at its discretion and as evidenced by a written policy, the date by which the final Trial Period Plan payment must be submitted before the servicer applies this option ("cut-off date"). The cut-off date must be after the due date for the final Trial Period Plan payment as set forth in the Form SG358 Permanent Loan Modification Trial Period Plan Notice.

Note: If the servicer elects this option, the borrower will not be required to make an additional Trial Period Plan payment during the month (the "interim month") in between the final Trial Period Plan month and the month in which the mortgage loan modification becomes effective. For example, if the last Trial Period Plan month is March and the servicer elects the option described above, the borrower is not required to make any payment during April, and the mortgage loan modification becomes effective, and the first payment under the Loan Modification Agreement is due, on May 1.

The servicer must incorporate into the Form 3179 the applicable provisions in accordance with the requirements in Fannie Mae’s Summary: Modification Agreement (Form 3179).

9.2.4.129.2.4.12 Executing and Recording the Loan Modification Agreement

The Servicer is responsible for ensuring that the mortgage loan as modified complies with applicable laws, preserves its first lien position, and is enforceable against the borrower(s) in accordance with its terms.

In order to ensure that the modified mortgage loan retains its first lien position and is fully enforceable, the servicer must take the actions described in the following table.

| The Servicer must… |

|---|

Ensure that the Loan Modification Agreement (Form 3179) (Note: Form 3179 is a required Form, only changes permitted by Fannie Mae or Freddie Mac are permitted) is executed by all the Borrower(s) who executed the original Note or individuals who acquired interest in the Mortgaged Property as a result of a transfer of ownership that was exempt from the Due-On-Sale Clause.

Note: The servicer may encounter circumstances where a co-borrower signature is not obtainable for the Loan Modification Agreement, for reasons such as mental incapacity or military deployment. When a co-borrower's signature is not obtainable and the servicer decides to continue with the mortgage loan modification, the servicer must appropriately document the basis for the exception in the servicing records. |

| Ensure all real estate taxes and assessments that could become superior to the first lien are current, especially those for manufactured homes taxed as personal property, personal property taxes, condo/HOA fees, utility assessments (such as water bills), ground rent, and other assessments. |

| Obtain a title endorsement or similar title insurance product issued by a title insurance company if the Loan Modification Agreement will be recorded. |

Record the executed Loan Modification Agreement if:

- recordation is necessary to ensure that the modified mortgage loan retains its first lien position and is enforceable in accordance with its terms at the time of the modification, throughout its modified term, and during any bankruptcy or foreclosure proceeding involving the modified mortgage loan; or

- the Loan Modification Agreement includes assignment of leases and rents provisions.

Note: The Servicer may charge the Borrower for any recording or similar costs associated with the Loan Modification.

|

If the mortgage loan is for a manufactured home, and the lien was created, evidenced, or perfected by collateral documents that are not recorded in the land records, the servicer must also take such action as may be necessary, including any amendment, recording, and/or filing that may be required, to ensure that the collateral documents reflect the mortgage loan modification, in order to preserve the first lien status for the entire amount owed.

The servicer must ensure proper execution based upon the entity that is the mortgagee of record and recording of the Loan Modification Agreement.

Servicers must allow at least 5 Business Days for any request to the MPF Provider or the MPF Bank to be reviewed. To avoid any delays, Servicers must ensure a submission is complete and accurate. See Section “9.1.8 MPF Provider and MPF Bank Response Time.”

In addition, the servicer must send the Loan Modification Agreement to the document custodian. If the Loan Modification Agreement is required to be recorded, the servicer must:

- send a certified copy of the fully executed Loan Modification Agreement to the document custodian within 25 days of receipt from the borrower, and

- send the original Loan Modification Agreement that is returned from the recorder's office to the document custodian within 5 business days of receipt.

If the Loan Modification Agreement is not required to be recorded, the servicer must send the fully executed original Loan Modification Agreement to the document custodian within 25 days of receipt from the borrower.

9.2.4.139.2.4.13 Loan Modification Corrections (10/18/24)

In the event an error is identified in a completed Loan Modification (eg: calculation errors), the MPF Provider will notify the Servicer, providing acceptable corrective actions and timeframes to correct the loan modification. Servicers are required to follow the instructions included in the notice.

9.2.4.149.2.4.14 MPF Reporting

The Servicer must report the mortgage loan on the Delinquent Mortgage & Bankruptcy Status Report (Exhibit B) monthly with an Action Code = 12, a Delinquency Status Code = BF during the Trial Payment Period or 28 after successful completion of the Trial Payment Period, the applicable Delinquency Reason Code, a Loss Mitigation Type = Modification or MODIFICATION accompanied by the Loss Mitigation Approval (effective) Date and Loss Mitigation Estimated Completion Date or Loss Mitigation Actual Completion Date, as applicable.

While prior approval by the MPF Bank is not required for Loan Modifications, Servicers must submit the Form SG354 (Note: Form SG354 must be used, no alternative or equivalent forms are permitted) via eMAQCSplus upon their completion.

9.2.4.14.19.2.4.14.1 Adjusting the Mortgage Loan Account Post-Mortgage Loan Modification

The servicer must complete the mortgage loan modification in accordance with Section “9.2.4.8 Offering a Trial Period Plan and Completing a Loan Modification.”

After a mortgage loan modification is executed and the Form SG354 has been submit to MPF Provider for processing via eMAQCSplus, the servicer must adjust the mortgage loan as described in the following table.

| ✓ | The Servicer must… |

|---|

| | Add any amounts to be capitalized to the UPB of the mortgage loan as of the date specified in the agreement. Usually, the capitalization date is one month before the new modified payment will be due. |

| | Revise the borrower's payment records to provide for collection of the modified payment. |

| | Apply any funds that

- the borrower deposited with the servicer as a condition of the mortgage loan modification,

- have been deposited on behalf of the borrower in connection with the mortgage loan modification, or

- the mortgage insurer contributed in connection with the mortgage loan modification.

Note: Amounts due for repayment of principal, interest, or advances must be remitted promptly to MPF Bank. The remaining funds may be used to clear any advances made by the servicer or to credit the borrower's escrow deposit account. |